Third Quarter Commercial Property Sales Wipe Out Most Year-to-Date Losses.

Frederick’s commercial real estate market has been slowly but steadily improving during the past three years, more or less paralleling the tepid improvements in the U.S. economy overall. There was no reason to expect that 2015 would be any different. But it has been different.

Frederick’s commercial real estate market has been slowly but steadily improving during the past three years, more or less paralleling the tepid improvements in the U.S. economy overall. There was no reason to expect that 2015 would be any different. But it has been different.

Frederick’s CRE market stumbled badly during the first two quarters of this year.

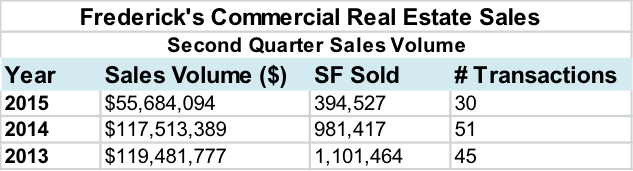

In fact, the second quarter commercial property sales results declined so sharply, and I took so much time double-checking numbers and trying to determine the cause, MacRo never got around to reporting them:

And what was the cause of that stumble? Well, everyone I asked had a different theory. And while all were probably contributing factors on a small scale, none was compelling enough to explain why the second quarter went into a free-fall.

And what was the cause of that stumble? Well, everyone I asked had a different theory. And while all were probably contributing factors on a small scale, none was compelling enough to explain why the second quarter went into a free-fall.

Remember the Magic 8 Ball? It’s a novelty toy that has been around for decades… a hard black plastic ball full of liquid, in which floats a many-sided die with vague little messages on each side that you can view through a small clear window. You shake the ball, ask it a question, then look through the tiny window to see what answer is pressed up against it.

For example:

“Magic 8 Ball, will the Cubs EVER get to the World Series?” *Shakes ball*

Don’t count on it.

“Magic 8 Ball, will Hillary or Donald win the election?” *Shakes ball*

Better not tell you now.

“Magic 8 Ball, will the U.S. economy ever fully recover?” *Shakes ball*

Concentrate and ask again.

You see how this works.

So the Magic 8 Ball is what I’m going to use from now on to predict Frederick’s commercial real estate market activity. (And I don’t even have to go to Toys R Us to buy one, because there’s an app for that.)

Frankly, I think the odds are at least even that any answer I get from the ball will be as good or better than extrapolating the macroeconomic predictions of world-renowned economists. There is no precedence for this rapidly maturing world economy we are a part of, so economic predictions are a dicey undertaking anyway. (Which at this point in history makes my plastic crystal ball just as good as any fancy economic algorithms.)

And while I’m making excuses, you know what else is really hard about predicting and analyzing Frederick’s commercial real estate economics? Like any tertiary market, Frederick is a really shallow market. There simply aren’t enough transactions in any given quarter to provide meaningful insights. One large office or apartment purchase by a REIT can throw off the whole dang curve.

“Magic 8 Ball, was the third quarter better for Frederick’s commercial market?” *Shakes ball*

Without a doubt.

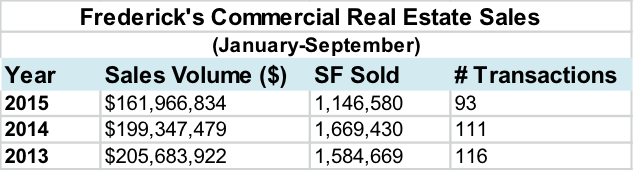

Ahhh, some good news for 2015! After a soul-searing second quarter, Frederick’s commercial property sales bounced back! Third quarter sales were so much stronger than the first half of 2015 that they nearly wiped out the year-to-date losses. Here are the results year-to-date:

(Aren’t you glad you didn’t find out about those terrifying second quarter results until now? You are so welcome.)

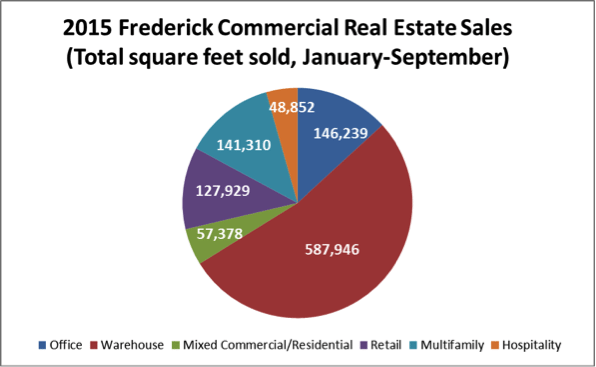

Here’s how commercial sales for the first three quarters of 2015 shook out by commercial property segment:

We’ll dissect the performance of each commercial segment at the end of 2015, but there was something of interest during the past quarter worth sharing in advance of year-end results. The warehouse segment has been fairly strong in the Frederick area, for reasons we’ve covered at length in past blog posts. And as you can see in the chart above, year-to-date warehouse sales represent the vast majority of commercial transactions on a total square foot sold basis. During this past quarter, however, office property sales outstripped warehouse both in terms of square footage sold and total dollar volume of sales. That is due both to a decline in warehouse sales and a steep rise in office property sales during the quarter.

We noticed this summer at MacRo that warehouse transactions had slowed as a percentage of our business…not sure if this is a temporary glitch of the third quarter or a trend to watch. Time will tell.

As we’ve reported during the past couple of weeks, here and here, the commercial leasing market didn’t fare quite so well during the third quarter. But we’ll take our wins where we can get them.

And as for the remainder of 2015…

“Magic 8 Ball, will 2015 be a good year for Frederick’s CRE market? “ *shakes ball*

Reply hazy try again.

Kathy Krach has served as a Vice President at MacRo and specialized in commercial sales and leasing. She is currently taking a sabbatical from brokerage activity, but continues to research and analyze Frederick’s commercial real estate market for MacRo, Ltd.