Low interest rates, steady consumer demand, and record high industrial production is fueling strong demand for industrial real estate despite stunted first quarter GDP.

Rumor has it that the U.S. economy will at long last reach full employment recovery–a gain of 9 million jobs from the trough of the recession–this summer. At five years, this recovery from “The Great Recession” has been twice as long in the making as that from the dot com bust in the early ’90s.

Rumor has it that the U.S. economy will at long last reach full employment recovery–a gain of 9 million jobs from the trough of the recession–this summer. At five years, this recovery from “The Great Recession” has been twice as long in the making as that from the dot com bust in the early ’90s.

The Great QE Taper doesn’t appear to be putting heavy pressure on interest rates, so let’s all hope that the abysmal first quarter GDP growth of 0.1% was a weather-related anomaly. Economists are banking on a combination of less drag from the government sector and more fuel from the housing sector to boost overall 2014 GDP into a more tolerable 3% range. (Economists are betting on the housing market because the U.S. is creating households at a faster clip than housing stock, which is pushing inventories to critical lows in many markets. However, I wonder if they are taking into account the impact of a trillion dollars of student loan debt on the economic capacity of those new households.)

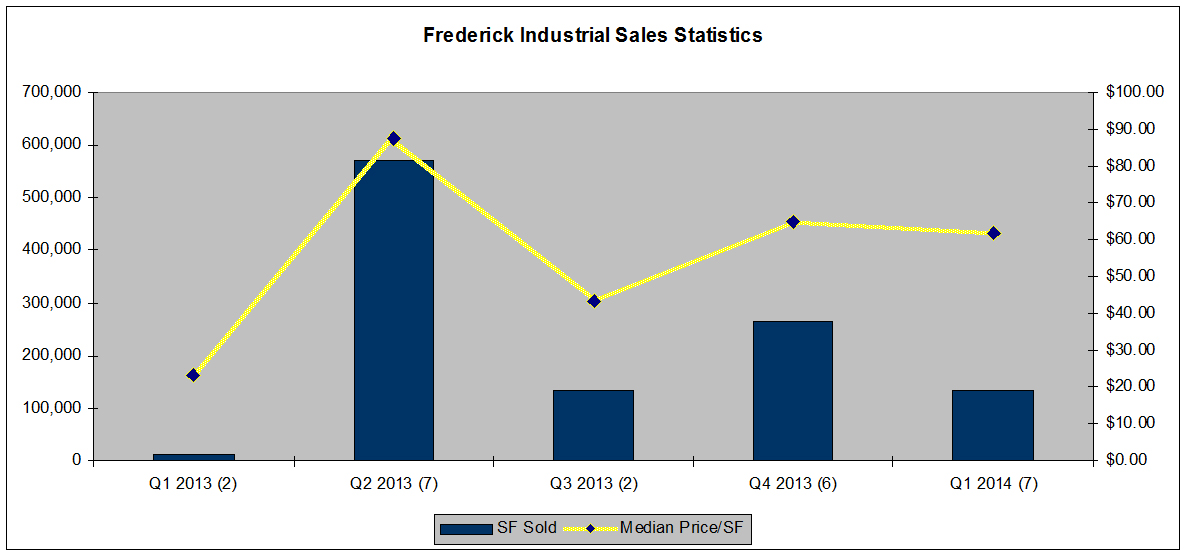

In the meantime, both industrial production and truck tonnage indexes posted all time highs during an otherwise lackluster first quarter, both of which translate into local demand for warehouse space. Frederick’s industrial market had a much stronger first quarter than the same time period last year. MacRo Report covered the top three industrial deals in Frederick’s Top 5 Commercial Deals for 1st Quarter 2014. Below are basic statistics on Frederick’s warehouse market for 2013 and the first quarter of this year:

The second quarter of 2013 results were boosted by a First Potomac REIT portfolio sale that included $38 million and 545,000 square feet worth of Frederick County warehouse properties.

Nationwide, industrial vacancy rates have dipped below levels not seen since the height of the real estate boom back in the mid ’90s. According to CoStar (the most comprehensive database of commercial real estate in the U.S.), Frederick’s industrial vacancy rate dropped to 11% for the first quarter of this year from 12.6% during the same time period of 2013. Properties that range in size from 0-100,000 square feet fall into CoStar’s “light industrial” category; most of Frederick County’s industrial properties fall under into this category. Nationwide, light industrial enjoyed the strongest rent growth and vacancy rate improvements of the warehouse segment during the past quarter.

Anecdotally, we are noting at MacRo that lease rates for industrial properties appear to have stabilized, and lease concessions are less generous than they were a year ago. That coupled with low inventories of warehouse properties in Frederick could be setting the stage for lease rate increases, assuming the economy gets back into a stable growth rate.

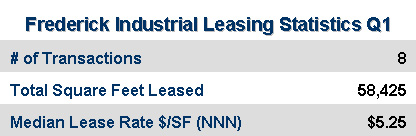

Following are Frederick industrial leasing statistics gathered from CoStar for the first quarter of 2014:

Note: Statistics provided for commercial property sales in this report are based on thorough research of every recorded commercial sales transaction listed in SDAT for the first quarter of 2014, and are deemed reliable. Lease transactions are not recorded with Frederick county government. Lease rates for this report were researched in CoStar. Lease rates, if reported at all, are usually estimated. Median lease rate calculations for the quarter are based upon available estimates and are meant to be used as a baseline trend versus hard data.

The author: Kathy Krach is a commercial sales and leasing agent with MacRo.