Leased Space in all CRE sectors drop to 38% of 2014 levels in the first three quarters of 2015, and two of four sectors see drops in lease rates as well.

The cold hard facts of a market fraught with an abundance of available inventory has come home to roost in 2015. As outlined in last week’s MacRo Report Blog post, the first three quarters of this year have not compared well to the same period of 2014.

The cold hard facts of a market fraught with an abundance of available inventory has come home to roost in 2015. As outlined in last week’s MacRo Report Blog post, the first three quarters of this year have not compared well to the same period of 2014.

This week the MacRo team will share with our fellow Frederick County CRE gurus the sector statistics we have gathered and analyzed. We look forward to your thoughts and comments.

The four segments that we looked at are Retail, Office, Industrial Flex and Industrial Warehouse located within the boundaries of Frederick County, Maryland and all of its municipalities.

The information we have gathered comes from a variety of reliable sources, including Frederick County tax records and CoStar (the world’s leading CRE database).

Retail:

About 134,300 square feet (SF) of commercial real estate was leased in the first 3 quarters of 2014 compared to 67,100 this year so far, which equals slightly less than 50% of last year’s total. The average size of the space leased fell by a factor of 67% or 2,095 SF against last year’s 3,123 SF. Additionally the average lease terms and number of lease transactions reflected similar percentages from 5.5 years to 3.8 years and 43 deals to 32, respectively.

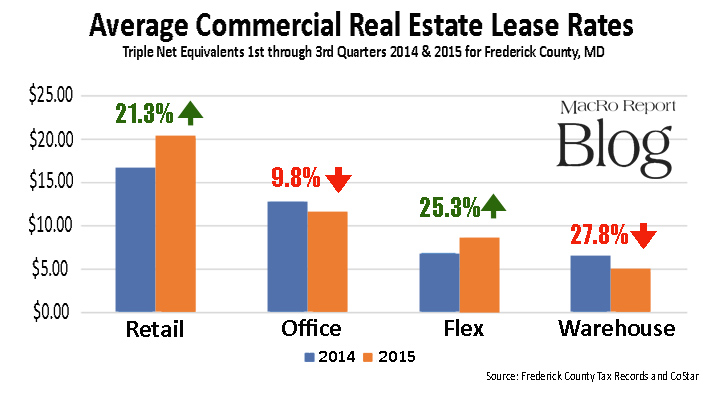

The good news for retail is that the triple net equivalent lease rates in the retail sector increased significantly from $16.59 to $20.13 per SF. This is likely due to the fact that there is limited inventory of vacant space available in prime retail locations.

Office:

The sector actually provided us with some “not so bad” results as compared to previous years. Clearly there is still a lot of vacant office space in the Frederick market, and while the statistics reflect as much, they did not dip as much as MacRo anticipated. During the first three quarters of 2014 about 147,000 SF was leased with an average unit size of 2,500 SF; 2015 has shown a drop to about 78% of the 2014 total—or 117,500 SF leased—while the unit size dropped to just shy of 2,000 SF.

Lease rates decreased on average from $12.77/SF NNN to around $11.52 thus far in 2015.

The good news in this sector is that the number of transactions and the average lease term actually jumped (while ever so slightly) by about 3.75% to 60 and 3.64 years, respectively.

Flex:

According to the data, the number of transactions in the flex market took a serious dip from 29 to 10 and also showed a similar percentage drop in the amount of square footage leased from 148,000 SF to 42,700 SF. The average size unit dropped by 83.6% to about 4,300 SF.

The good news for flex is that the average triple net lease rate appears to have jumped by about 25% from $6.87 to $8.61 SF. Additionally the average lease term bumped up from 2.8 years to 3.

Warehouse:

It appears that the Industrial Warehouse sector took the biggest hit in the category of total leased space during this comparison period. With 2014 numbers showing about 332,500 SF leased, only 62,800 were booked thus far this year—this represents an 81% drop!

The average unit size got slammed as well—down to 35% of 2014 levels to 5,200 SF. Lease rates seemed to fall in line with the slide from a triple net figure of $6.47 to $4.67 per square foot. Adding to the warehouse pain is data that shows only 12 transactions were logged compared to 22 during the first 3 quarters of 2014.

Yes, the warehouse market did have some good news with average lease terms increasing from 3.1 years to 4.5 years thus far this year.

Are the good times over for the Frederick County commercial real estate market?

We say absolutely not. As noted last week a market full of vacant space combined with a demand for smaller unit size will often see severe swings as property owners and landlords seek methods to adapt to changing market trends.

While this recovery has been very slow, MacRo strongly suspects that the fourth quarter of 2015 will show some very nice surprises.

Become a MacRo Insider

The authors:

Rocky Mackintosh, President, MacRo, Ltd., a Land and Commercial Real Estate firm based in Frederick, Maryland. He has been an active member of the Frederick, Maryland community for over four decades. He has served as chairman of the board of Frederick Memorial Hospital and as a member of the Frederick County Charter Board from 2010 to 2012, to name a few.

Kathy Krach has served as a Vice President at MacRo and specialized in commercial sales and leasing. She is currently taking a sabbatical from brokerage activity, but continues to research and analyze Frederick’s commercial real estate market for MacRo, Ltd.