It’s a good news/bad news kind of market for office leasing in Frederick.

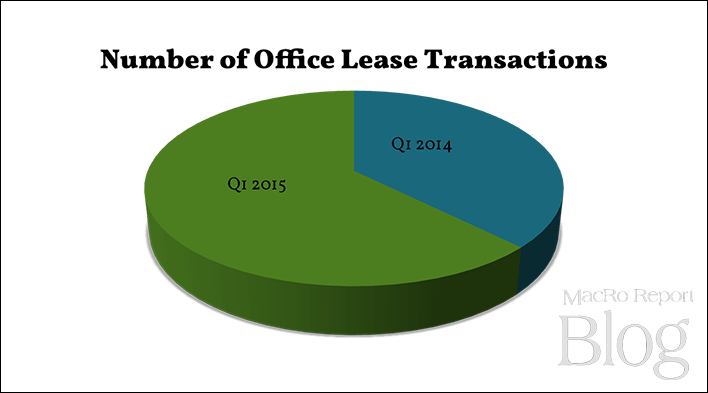

Let’s start with the good news: Lease transactions for office space in Frederick were up by more than 65% for the first quarter of 2015 (25 deals) versus the first quarter of the previous year (15). And there is more good news: Flex space inventories have thinned out considerably, and traditional office spaces once again represented the lion’s share of office lease transactions.

Let’s start with the good news: Lease transactions for office space in Frederick were up by more than 65% for the first quarter of 2015 (25 deals) versus the first quarter of the previous year (15). And there is more good news: Flex space inventories have thinned out considerably, and traditional office spaces once again represented the lion’s share of office lease transactions.

(No, 25 office lease transactions is not a lot of data to mine. According to CoStar, there were only 40 commercial lease deals closed last quarter in the entire county. Frederick’s commercial real estate market is still relatively shallow compared to where it was prior to the Great Recession. However, even a shallow cup yields a few tea leaves to read. The trends in Frederick’s commercial real estate market as a whole usually reflect what we experience in our day-to-day transactions at MacRo, which makes them compelling enough to dissect.)

The not-so-good news for office leasing in Frederick is that the empty Bechtel campus, along with other large single-user office building vacancies, are putting considerable pressure on an already beleaguered segment of commercial real estate.

It’s sobering to note that about 1.3 million square feet of Frederick’s office space is vacant currently, which represents about 27% of the inventory. (We have written extensively about the reasons behind the high vacancy rates in the office segment, but if you’ve missed those posts check out this one, and this, and also this.)

Landlords of commercial office buildings across Frederick have grown increasingly weary of waiting for large national employers to fill the vacancies, and have embraced the small business tenant. With the exception of one deal at 5,132 square feet, every office lease deal in Frederick during the last quarter was for a space smaller than 3,000 square feet.

The transition of single-user buildings to multi-tenant buildings brings with it a host of interesting challenges, including a significant increase in core factor and management expenses, as well as “lease term shock.” Lease term shock is what a landlord experiences when a smaller business owner refuses to sign a lease for more than a 3-year term (versus the 5-7 year terms that banks prefer to see, and much lower than the 10-15 year terms that large national employers traditionally sign for). Small business owners are still playing their cards very cautiously, waiting for the economy to start making sense again. (Not going to happen, by the way.)

It’s difficult to get hard data on lease rate trends–unlike sales, leases are not recorded with county government. We have to be content with watching listed properties for lease, and asking local brokers what they are seeing and hearing as deals are being made.

And what we are seeing and hearing is that office landlords are beginning to negotiate generously: in some cases, writing leases at rates that barely cover operating expenses of their office buildings. Suffice it to say office leasing is a highly competitive market, and we caution our clients to treat their current office tenants like the gold they are.

A renewal in the hand is worth 10 potential new tenants shopping the market.

Beware the office tenant’s market, however.

We caution clients on the other side of the table—office users shopping for new space—to be careful about leaping at the cheapest deals out there. We are fielding inquiries from small businesses who thought they had found the deal of the century on leased space, only to discover once they had moved in that the landlord was in serious financial distress. Some are fleeing their buildings because the landlord is desperately jacking up rents or fees to stave off foreclosure; others are fleeing because their landlord is allowing the building to deteriorate.

We caution clients on the other side of the table—office users shopping for new space—to be careful about leaping at the cheapest deals out there. We are fielding inquiries from small businesses who thought they had found the deal of the century on leased space, only to discover once they had moved in that the landlord was in serious financial distress. Some are fleeing their buildings because the landlord is desperately jacking up rents or fees to stave off foreclosure; others are fleeing because their landlord is allowing the building to deteriorate.

A great landlord is a valuable asset to a busy business owner, but many don’t realize it until they no longer have a great landlord. (Perhaps in some cases it’s more a “the devil you know is better than the devil you don’t” situation. Either way, Buyer Beware applies to tenants as well.)

In other news, all was quiet on the industrial and flex front during the first quarter. There were only six transactions between those two segments last quarter, versus 23 the previous year. Total square feet leased in those segments was only 34,635 versus 141,828 the year before. I assume this is a temporary blip given that demand for high bay warehouse buildings in Frederick was so strong during 2014 Matan is preparing to build more of it.

Retail leasing in Frederick remained stable, at nine transactions last quarter versus eight the year before, and approximately 25,000 square feet leased versus about 27,000 the year before.

Overall, a total of 93,637 square feet of commercial real estate was leased during the first quarter of this year, less than half of the 197,993 square feet leased first quarter of 2014. Most of that difference was attributable to the lack of large deals in the industrial/flex segments last quarter. Again, I expect that was an anomaly but we will watch it carefully as the year progresses.

The author: Kathy Krach is a Vice President at MacRo specializing in commercial sales and leasing.

Data used for this article was gathered from sources deemed to be reliable, although MacRo has not independently verified it and does not guarantee that it is correct.