Yes, it is true income can go up and down at the same time … for the same people no less! How can that be? Well, grab an apple … and an orange, while you’re at it, and read on.

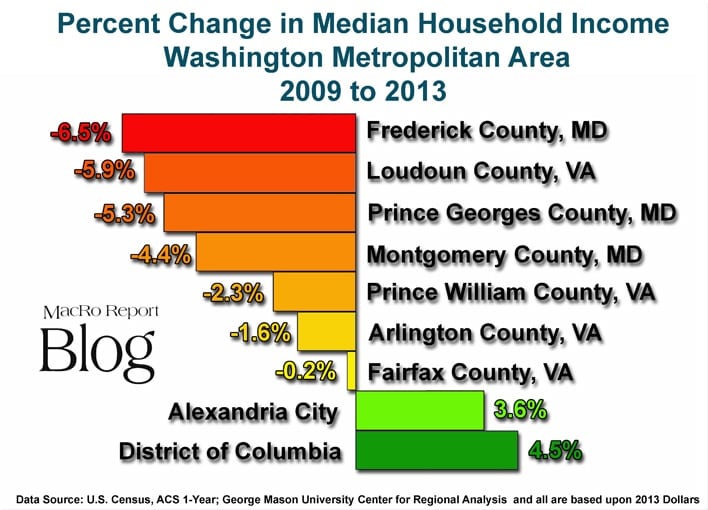

A funny thing has been happening in Frederick County coming out of the recession. Frederick County’s median household income fell by a rate of 6.5% between 2009 and 2013 from $90,164 to $84,308. Using 2013 dollars, this reflects an inflationary adjustment factor of about 7.9% over that period.

A funny thing has been happening in Frederick County coming out of the recession. Frederick County’s median household income fell by a rate of 6.5% between 2009 and 2013 from $90,164 to $84,308. Using 2013 dollars, this reflects an inflationary adjustment factor of about 7.9% over that period.

Of the nine jurisdictions (seven counties and two cities) tracked in the Washington Metropolitan Area by Stephen S. Fuller, Ph.D., director of the George Mason University Center for Regional Analysis (CRA), Frederick County’s median household income has suffered the greatest blow.

Seems that except for Prince William County, Virginia, the closer the jurisdiction is to the District of Columbia the better household income has fared during that period.

Seems that except for Prince William County, Virginia, the closer the jurisdiction is to the District of Columbia the better household income has fared during that period.

Back here locally, the office Frederick County Business Development and Retention has statistics that — on the surface — seem to contradict the information compiled by Fuller, showing very comfortable increases in population and the average (mean) weekly wage during that same timeframe!

Between 2009 and 2013 Frederick County’s overall population increased by nearly 10,500 residents (from 230,942 to 241,409), about 51% of that increase paralleled a jump in the number of jobs by 5,386 (90,637 in 2009 to 96,023 in 2013) … and the weekly wage increased within the same timeframe from $845 to $911 (annualized: $43,940 to $47,372). Respectively, those are increases 5.9% and 7.8%!

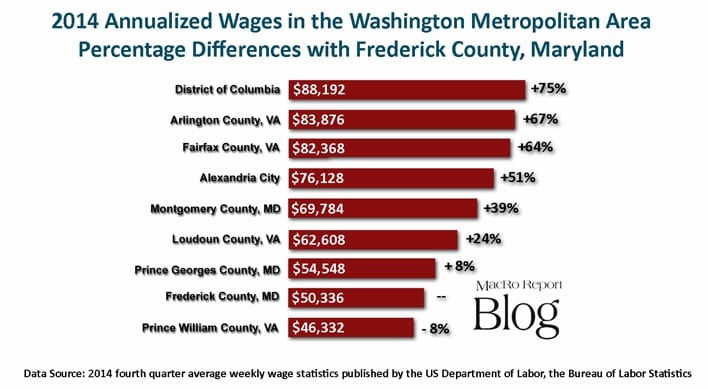

The good news keeps on coming! Look at the 2014 fourth quarter statistics published by the US Department of Labor, the Bureau of Labor Statistics. The Frederick County average weekly wage reached $968. Annualized, that is $50,336. This shows a steady average increase of 2.4% during the period of 2009 through 2014.

So what gives?

How can the Frederick County’s median household income drop by 6.5% and average weekly wages increase by 7.8% between 2009 and 2013?

How can both of statistics be correct?

Are things getting better for the citizens of Frederick County or worse?

First let’s dig a bit deeper on the average weekly wage stats and look at things from the perspective of all nine jurisdictions that make up the Washington Metropolitan area.

How does the annualized 2014 weekly wage in Frederick stack up to the rest of the pack?

Once again excluding Prince William County from the mix, Frederick County wages sit at the bottom of the remaining stack of seven. Consider that annualized wages in Montgomery County, Maryland and the District of Columbia rate 39% and 75% higher than Frederick. Even Loudoun County, Virginia our immediate neighbor to the south pays 24% better.

Once again excluding Prince William County from the mix, Frederick County wages sit at the bottom of the remaining stack of seven. Consider that annualized wages in Montgomery County, Maryland and the District of Columbia rate 39% and 75% higher than Frederick. Even Loudoun County, Virginia our immediate neighbor to the south pays 24% better.

My take on this is “Wow, those are truly significant differences, which in the end puts strong pressure on Frederick County public and private employers when trying to compete in a time of slow recovery.”

Now let’s take a look at the median household income.

First what is the difference between the term median and average? While most understand that average is the sum of all parts divided by the number of parts, median is quite different.

Ben Casselman, an economic writer with FiveThirtyEight.com, proclaimed that The American Middle Class Hasn’t Gotten a Raise in 15 Years in a September 2014 article. In that post he defines “median income” in this way:

The amount of money earned by the household at the midpoint of the U.S. income distribution — half of households make more, and half make less. Journalists … often refer to it as the amount earned by the “typical household,” which is true as long as we’re talking about a moment in time. But as soon as we start talking about change over time, median income becomes trickier to interpret.

The key word Casselman uses in that statement is CHANGE.

Averages are averages, but Median is not the average. As noted Median is a snapshot in time; so when comparing the median income of one period to that of another, CHANGE HAPPENS and fools many. Consider the following:

- The average household size in Frederick County has been dropping steadily from 3.72 members in 1970 to 2.7 in 2010. The US census estimates that trend will steadily continue resulting in 2.4 members by 2040.

- There is a significant shift from two member household earners to single. For example look at the divorce rate, which continues to create new households all the time. Splitting a household into two usually lowers the median income of the total. According to research gathered from the American Enterprise Institute, “The percent of married couple households has fallen from more than 60 percent in 1980 to less than 50 percent in 2010.”

- Fewer people are getting married which create many single member households as the offspring of the Baby Boomers “finally” leave the nest!

- Speaking of Baby Boomers, as this generation is creating a quarter of a million 65 year olds on an annual basis, more of these folks are retiring from (or being pushed out of) full-time higher paying jobs than the number of younger earners who enter the workforce at the same time. The US Census Bureau projects that “by 2029, when all of the baby boomers will be 65 years and over, more than 20 percent of the total U.S. population will be over the age of 65.”

- When a significant employer enters (or exits) a market, many of its higher wage earners may relocate with the firm. Take for instance the exit of Bechtel from Frederick County to Virginia. Does anyone think such a change will not have some impact average weekly wages or the median household income?

There has not only been a demographic shift in the changing face of the American household, but the Washington Metropolitan area is experiencing a significant change in the job market. In January 2015 The MacRo Report Blog post noted that between federal sequestration and the heavy debt burdening Maryland’s economy, the state has already been experiencing a drop in government jobs as a percentage of the workforce.

According to statistics gathered by Fuller, “federal payroll declined by $2.4 billion or 5.7% between FY 2010 and FY 2014 and will continue to decline as the workforce shrinks and older workers retire and are replaced by younger workers.” Job shifts from public to private sectors for older workers often result in average lower wages for those impacted.

Bottom-line is that the factors that are plugged into defining the “typical household” are always changing. Trends since 1970 clearly show that while the national number of households are exponentially growing at a higher rate than the population, the household size has been shrinking steadily at the annual rate of 0.03%.

And as they say SIZE MATTERS! The smaller the household size, the lower the median income will likely be … no matter how well or bad the economy is faring.

Casselman points out another interesting fact regarding the shrinking “typical household.” In 1970 those living in such abodes represented 60 percent of the total and earned 55 percent of all U.S. Income. By 2013 both of those factors dropped to 45 percent. In other words the median household of today is less than average.

In terms of buying power, with shrinkage typically comes higher basic per capita costs from that income for such things as housing, food and transportation, which in the end lessens the income for investment and disposable purchases.

To conclude, either way we look at it, positives and negatives can be derived from median household income and average wages statistics. But to compare the two, yes … it’s one of those “apples and oranges” things.

In the case of Frederick County with the median falling and the average increasing, residents should count their lucky stars that things aren’t so bad compared to the very soft conditions of other markets scattered throughout the nation. However with dynamic demographic shifts and a “sputteringly” positive economic recovery, the competitive nature of neighboring jurisdictions can be so intense that it is not safe to hover around the bottom of the pile whether things are decreasing or increasing.

Local economies can be very fragile in highly competitive times.

In a series recent presentations given to a cross section of business leaders in Montgomery County and other jurisdictions within the Washington Metropolitan area CRA’s Fuller stated that “fresher approaches for economic development” are necessary for any jurisdiction to compete regionally or globally. It must be recognized that an area’s human and capital resources are more mobile now than ever before.

Attracting great jobs to a market and retaining existing jobs is an essential component to bring about higher value-added growth and a well-paid workforce. Fuller suggests that:

- Competitive assets must be maximized

- Local assets should be used to their fullest advantage

- The community’s assets must be leveraged in concert with assets of the regional economy; and

- It must be recognized that agglomeration economies build on independencies.

So, chew on that for a while!

Want to know what is up and down? Sign up for the MacRo Report Blog!

The author: Rocky Mackintosh, President, MacRo, Ltd., a Land and Commercial Real Estate firm based in Frederick, Maryland. He has been an active member of the Frederick, Maryland community for over four decades. He has served as chairman of the board of Frederick Memorial Hospital and as a member of the Frederick County Charter Board from 2010 to 2012, to name a few.