As Frederick’s office market thaws, a clear picture emerges of the “new normal.”

As I sit typing this post, I’ve got my windows thrown open to the sound of water running off the roof and down the gutters, as Frederick at last begins to thaw out from a long frigid winter. It’s a balmy 45 degrees outside!

As I sit typing this post, I’ve got my windows thrown open to the sound of water running off the roof and down the gutters, as Frederick at last begins to thaw out from a long frigid winter. It’s a balmy 45 degrees outside!

Frederick’s office market has suffered a hard winter too—an epic freeze more like a storyline out of Game of Thrones than a typical economic cycle. Of all commercial real estate segments, the office market was the hardest hit nationwide during the recession.

MacRo Report has covered various pressures on the office real estate market during the past several years: an evolution in office space layout and use; a steep increase in telecommuting; the great recession; the flight of large employers (like Bechtel) to more tax-friendly climates; an increasing share of office-space-as-a-service companies (like Regus) in the local market; and the migration of traditional office users into flex space to save money.

According to CoStar, there is 1.2 million square feet of usable traditional office space vacant in Frederick, which represents a vacancy rate of about 13%. That vacancy rate has plateaued during the past three years, give or take a point or two. Once vacancy rates dip below 11%, Frederick’s office market will be back in a healthier range.

Costar also reports that the current average listing lease rate for office space in Frederick is about $21 full service, although the deals actually being struck are generally below that figure. (More and more office landlords are choosing to adopt full service leases, as opposed to triple net. This lease structure is popular with tenants and landlords alike, for a variety of reasons.)

It isn’t a question of whether Frederick’s office market will thaw completely—it will. The greater unknown is what the office market will look like when it has stabilized.

Will a new “business friendly” governor successfully lure large employers to the region to replace the gaping holes left by Bechtel and Capital One? Will local bio-tech incubators feed the Frederick office market with start-ups? Will Regus take space downtown as they expand their market share, as has been rumored for the past several months? Will large empty office buildings be repurposed into mixed-use multifamily retail spaces, as developers in large metropolitan areas are doing?

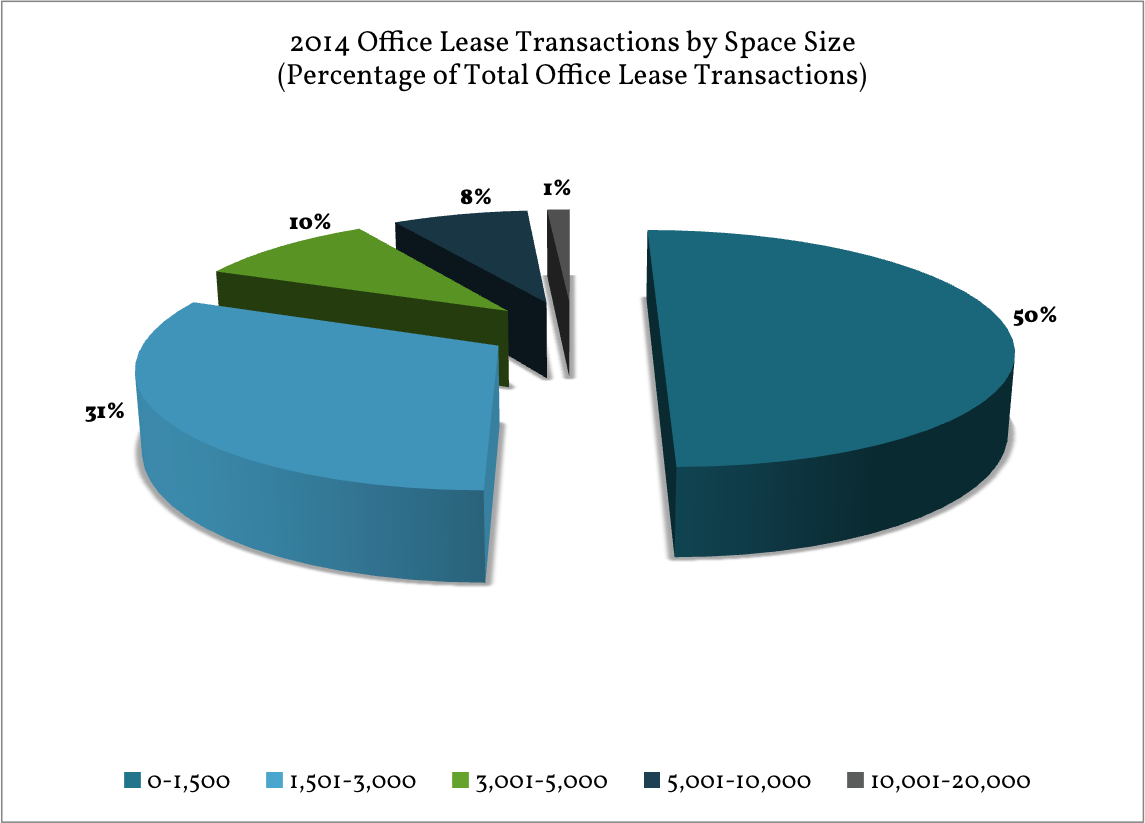

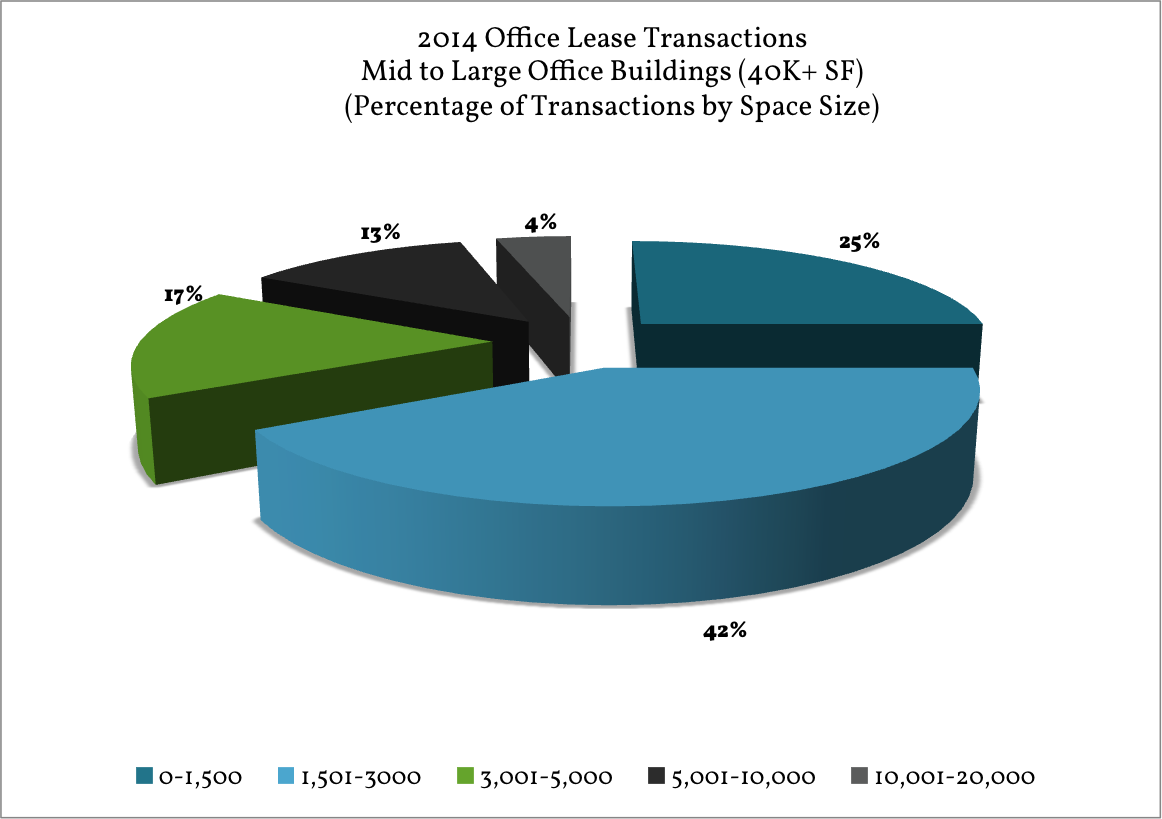

Some—or maybe all—of these variables will contribute to Frederick’s office market recovery. In the meantime, when attempting to peer into the murky depths of a crystal ball, it is always a good idea to start with a clear picture of where we are now. In the following charts, we broke out Frederick’s 2014 offices deals by the size of the spaces leased in order to show which users are the most active in the market.

It’s clear that the dominant players in Frederick’s office market last year were small users—3,000 square feet or less. These users signed for lease terms of less than 3 years on average. (This is exactly why Regus is growing in leaps and bounds throughout this region.)

It’s clear that the dominant players in Frederick’s office market last year were small users—3,000 square feet or less. These users signed for lease terms of less than 3 years on average. (This is exactly why Regus is growing in leaps and bounds throughout this region.)

Landlords struggling with high vacancies in mid-sized office buildings would do well to take note of this, and demise vacant interior spaces accordingly if they wish to court the most active demographic in Frederick’s office market.

One local office investment company has had the foresight to do just that: Carroll Properties, LLC is actively courting small businesses to fill vacancies in their 80,000 square foot building at 5301 Buckeystown Pike. This building is uniquely suited for demising large office spaces into smaller footprints, and with MacRo’s help they are marketing the building accordingly.

One local office investment company has had the foresight to do just that: Carroll Properties, LLC is actively courting small businesses to fill vacancies in their 80,000 square foot building at 5301 Buckeystown Pike. This building is uniquely suited for demising large office spaces into smaller footprints, and with MacRo’s help they are marketing the building accordingly.

“We believe that 5301 Buckeystown Pike is the next opportunity for the businesses looking to grow from a Regus environment. Those users are growing into the 1,500-3,500 square foot office suites.,” said Jeff Joy, Chief Operating Officer of Cross & Company, LLC, the property manager for Carroll Properties, LLC.

“This is a building that offers a Class A big tenant environment—formal lobbies (recently renovated), elevators, stunning views, abundant parking, building management on-site—to the small business user,” continued Joy. “We understand what small and medium-sized businesses need from their landlords because we are a small business ourselves. We take pride in managing every aspect of the building so that our tenants can focus on operating and growing their own businesses.”

The market is heating up way ahead of the weather. Let MacRo advise you on the best pricing and marketing strategy for your vacant office spaces in time for the spring market.

Contact Kathy Krach at

301-9696 ext. 205

or kathy@macroltd.com

Stay in the know about Frederick Real Estate by subscribing to the MacRo Report blog.

*Data used for this article and graph was gathered from CoStar, the nation’s leading provider of commercial real estate trends and intelligence. The information is deemed to be reliable, although MacRo has not independently verified it and does not guarantee that it is correct.