As key downtown Frederick properties change hands at higher prices, lease rates can expect to continue to rise.

When it comes to the evolution of the gentrification in downtown areas, I guess it’s a chicken versus the egg kind of question in the world of commercial real estate versus residential. At the end of day, it really doesn’t matter if the downtown residential has caused the rise in downtown mixed residential/retail property values to climb in sales and lease rates, but there is very strong evidence that it is happening with a vengeance over the last several quarters.

When it comes to the evolution of the gentrification in downtown areas, I guess it’s a chicken versus the egg kind of question in the world of commercial real estate versus residential. At the end of day, it really doesn’t matter if the downtown residential has caused the rise in downtown mixed residential/retail property values to climb in sales and lease rates, but there is very strong evidence that it is happening with a vengeance over the last several quarters.

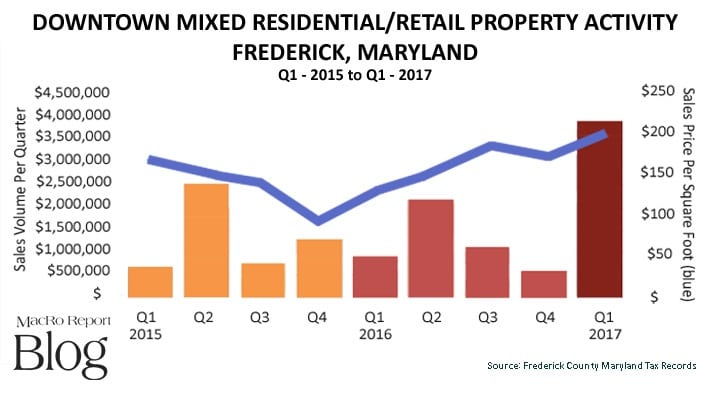

Consider that in the fourth quarter of 2015 just shy of 14,000 square feet of mixed residential/retail real estate changed hands in 6 transactions within Frederick’s core downtown area at an average transfer rate of $93.32/SF.

Now, just 5 quarters later, at the end of March 2017, 19,600 square feet changed hands in the same number of transactions at an average figure of $201.36/SF.

When property resale values increase at such rates, the only way to justify the investment is to consider the revenue side of the equation.

During this same 18-month period, I think brokers and appraisers who are familiar with the downtown Frederick residential and commercial leasing market will agree that rates are also rising. There was a time not too long ago when it wasn’t unusual for retail and office tenants in the core areas of the city to be paying base lease rates in the low teens per square foot for street store front space, but now as the social and economic vibrancy of downtown continues to grow and become “discovered”, more investment dollars have been injected into the acquisition and renovation of mixed residential/retail properties.

These forces have been pushing base lease rates into the high teens and mid-twenty-dollar price range.

The downside of such market pressures is that, as has been the case for the last couple of decades, more and more of the “Mom and Pop Shops” have had to face the music that they may not be able to afford the steady and often surprising rent increases that landlords request. Some have owned their own buildings and have found the enticement of higher real estate values very appealing, causing them to make the decision to cash out. Long established office and restaurant tenants often find themselves in the same situation.

At the end of the day, the law of supply and demands rules, and downtown Frederick is no different than any other market when it comes to that rule.

Consider two recent transfers that took place in the first quarter of 2017:

200–202 South Market Street is a 3-story mixed residential/retail property at the corner of South and South Market Streets. It was purchased by Robert and Abby Laughlin in 2004 for $325,000. They completely renovated the property. With apartments on the upper 2 floors and Il Porto Restaurant at street level, the property transferred in January 2017 for $1,800,000 – at 7,800 square feet, that’s $230.00/SF.

69 South Market Street is another mixed residential/retail property that has been owned by the Horman family for many years.

A bit of trivia: Well-known and legendary local attorney Seymour B. Stern grew up in one of the upper level apartments above what is now a Subway franchise restaurant.

This 6,432-square foot building with a rare number of off-street parking spots sold in February 2017 for a price of $204.45/SF or in whole numbers $1,315,000.

These are only a couple of examples of what has been happening in (and to) downtown Frederick over the last several decades. The only difference now is that with what appears to be a strengthening economy and the mere attractiveness of our city is discovered, real estate sales and leasing values (and gentrification) will only increase exponentially.

Rocky Mackintosh is President of MacRo, Ltd., a Land and Commercial Real Estate firm based in Frederick, Maryland. He has been an active member of the Frederick, Maryland community for over four decades. He has served as chairman of the board of Frederick Memorial Hospital and as a member of the Frederick County Charter Board from 2010 to 2012. He currently serves as chairman of the board of Frederick Mutual Insurance Company. Established in 1843, it is one of the longest enduring businesses in Frederick County.