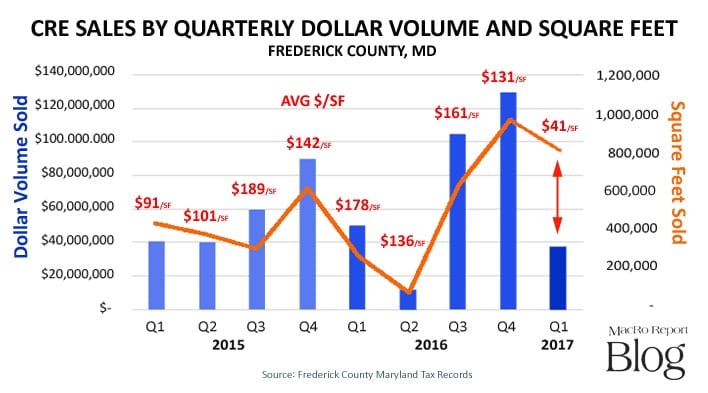

A perfect storm of sorts hit the records of Frederick County commercial real estate transfers during the first three months of 2017. While the number of transactions last quarter was about average, overall sales volume of improved commercial real estate dropped to its second lowest figure over the last nine quarters.

perfect storm of sorts hit the records of Frederick County commercial real estate transfers during the first three months of 2017. While the number of transactions last quarter was about average, overall sales volume of improved commercial real estate dropped to its second lowest figure over the last nine quarters.

Out of the 33 transactions in last quarter, there were two sales that caused the average sales price per square foot to fall from $118/SF to a mere $41/SF. These two transfers made up a combined total of 767,200 square feet at a price of $17,188,000 – that’s 81% of the overall figure of 907,000 SF and 44% of the $37,235,000 in volume.

While one of the market correctional transfers made front page headlines, the other also had a significant impact on market figures, as well.

The Mall

The Frederick Towne Mall was sold at auction on Monday, February 13, 2017 for $6,250,000. The 615,000 square feet retail structure that sits on over 39 acres of commercially zoned land on the western end of the once famed Golden Mile, changed hands at a figure of $10.16/SF of improved area, or, looking at it in another way, at a price of $158,800 per acre ($3.65/SF) of land area.

Either way, these figures reflect an opportunity for another shot at revival of some kind. The previous owner Rockwood Capital had spent a considerable amount of time, effort and funding to redevelop the site into a mixed use project with a Wal-Mart as the anchor retailer. But as most Frederick Countians know, after much community opposition, the well-known retailer pulled out of the deal, which caused Rockwood to fold up its tent.

The new owner is West Frederick Center, LLLP, a limited liability limited partnership that is headed up by longtime local urologist Dr. Mohammed M. Mohiuddin. At present, the good doctor and his investors apparently plan to work actively to make some improvements to the existing buildings and re-lease the once renowned structure.

The Office Building

The transaction that garnered less notoriety was the sale of the former headquarters of Farmers & Mechanics National Bank and has been the regional home of its predecessor PNC Bank. Just a few days before the end of this past March, well-known local investor/developer/philanthropist Marvin Ausherman picked up the 21 acre site with 116,240 square feet of office space for his ever-growing investment portfolio.

Following the recent sales history of this property over the last 12 years, gives one a good snapshot of the struggles that the overall suburban office market has been experiencing not just locally, but nationally. Consider that Farmers & Mechanics sold the property in 2005 to 110 Thomas Johnson, LLC at a price of $17,000,000 ($146/SF).

Seven years later in the summer of 2012, “110” sold the property for $16,511,000 ($142/SF) to Frederick MD Green, LLC, who 5 years after that (2017) accepted an offer from Marvin to take it off its hands at a figure of $10,200,000. This translates to $87.75/SF, much less than replacement cost, and even a better deal especially knowing the site has future subdivision development options.

First Quarter Reflections

After putting these two transfers in perspective, the breakdown by sector looks like this:

- Retail: In addition to the sale of the Frederick Towne Mall, there were 9 other deals that closed for a total of $7,145,000 totaling 40,100 SF with an average price per SF at $178, which is spot on for the average of the last 2 years.

- Office: Besides the Ausherman purchase, another 23,500 SF in 5 transactions closed last quarter. Total of $3,155,000 equaled an average sale of $134/SF, which is significantly less than the $164/SF for all office space sold in 2016.

- Warehouse: 72,000 square feet changed hands at the gross figure of $2,200 less than $5 million. These five sales averaged about $69/SF, with one of these being the transfer of a 25% interest in the 35,800 SF Service Glass Building on Monocacy Blvd at a figure equal to $82.44/SF.

- Multifamily: Not a banner quarter for this sector, as there were only 2 minor transfers totaling about 12,700 SF of older properties in the downtown areas of Frederick and Emmitsburg. The $777,000 in sales equated to an average of $61/SF, well less than half of what has been averaged for the last two years when major projected are factored in.

- Mixed Use Residential/Commercial: This sector has earned its own upcoming blog post, as it is becoming more apparent that the gentrification of downtown Frederick is starting to have a positive impact on sales prices. Ten transfers for the quarter yielded $4.7million in sales. With a total of 27,100 SF, the average price per square foot popped to $173.50. <lt;/span>

Stay tuned to for some interesting statistics.

In summary, the $38million of sales volume of improved commercial real estate in Frederick County for the first quarter of 2017 fell 58% below the $59 million average of the previous 8 quarters, but at the same time the total square feet sold of 907,000 SF was more than double the same period’s average of the 451,000 SF.

This is what happens when the forces of market correction randomly happen throughout the year … and while there are more to come, the underlying foundation of the CRE market appears to be gaining strength.

Rocky Mackintosh is President of MacRo, Ltd., a Land and Commercial Real Estate firm based in Frederick, Maryland. He has been an active member of the Frederick, Maryland community for over four decades. He has served as chairman of the board of Frederick Memorial Hospital and as a member of the Frederick County Charter Board from 2010 to 2012. He currently serves as chairman of the board of Frederick Mutual Insurance Company. Established in 1843, it is one of the longest enduring businesses in Frederick County.