Buyers snapped up Frederick office condos , while tenants leased four times as much flex space as office.

It’s apparent when viewing the chart reporting square footage of commercial real estate transactions by segment in Frederick Commercial Sales Jump 66% during 1st Quarter, that warehouse properties were the darling of Frederick’s first quarter commercial real estate market. The office segment, on the other hand, continues to face a difficult climb out of the recession, as office use continues to evolve dramatically and inexpensive flex spaces absorb tenants who would have been class A or B office tenants less than a decade ago.

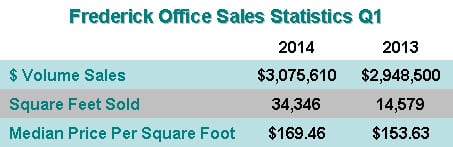

That said, the office sales market in Frederick appears to be making some modest gains, at least in terms of sales price and volume.

The median price per square foot of Frederick office space increased about 10% compared to Q1 2013, while total square feet sold jumped 135%. There were no purchases of flex properties by traditional office owner/users during the first quarter of this year, and only one sale of a flex condo during the first quarter of 2013 at a price of $106.12/SF. Medical office condominiums fetch higher prices; a medical office condominium at Conley Farm sold for $237.51/SF last quarter.

Small businesses and medical practices seeking office condos represented most of the activity in office sales last quarter, as low interest rates and loosening credit markets tipped the scales in favor of owning versus leasing.

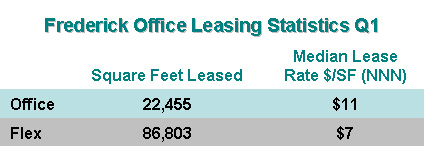

But speaking of leasing, flex was the clear winner last quarter with office tenants. Vacant flex properties like those offered by St. John Properties continue to put pressure on the office leasing market, mainly due to the affordability factor: compare the median per square foot lease rate for flex of $7/NNN versus $11/NNN for office space during the past quarter. On a square foot volume basis, flex outpaced office by nearly 4 to 1 during the first quarter of 2014.

St. John Properties, which about 18 months ago had 1/4 million square feet of vacant flex space in Frederick, appears to be leasing that inventory at a brisk pace, which is good news for the traditional office segment in Frederick.

Note: Statistics provided for commercial property sales in this report are based on thorough research of every recorded commercial sales transaction listed in SDAT for the first quarter of 2014, and are deemed reliable. Lease transactions are not recorded with Frederick county government. Lease rates for this report were researched in CoStar. Lease rates, if reported at all, are usually estimated. Median lease rate calculations for the quarter are based upon available estimates and are meant to be used as a baseline trend versus hard data.

Become a MacRo Insider

The author: Kathy Krach is a commercial sales and leasing agent with MacRo.