We welcome Frederick County appraiser Michael Pugh with his first post to the MacRo Report Blog

During the past several weeks there has been much attention given (and deservedly so) to the distressed commercial and industrial real estate market. This article focuses on another area of the industrial real estate market — vacant land — that is facing difficult times. Vacant industrial land sales have decreased considerably in Frederick County during the past two years. Much like improved industrial and office properties, employment growth or loss in the market area drives value. Data derived from sales of vacant industrial lots — which are in decline throughout Frederick County — illustrates this relationship and reveals a higher-risk environment for owners and investors in industrial property.

The macro-economic factors which led to the world financial crisis that began in September 2008 had an immediate impact at the micro-economic level which in the Frederick County and mid-Maryland region resulted in lost jobs. Unemployment levels have increased considerably since that time — at one point national levels reached above 10 percent, the highest national unemployment rate since the recession of the early 1980s. Frederick County’s unemployment levels have nearly doubled during this same time period. As you can see from the following graph, unemployment levels in Frederick County remained relatively constant throughout 2005 until the third quarter of 2008. Frederick County’s unemployment rate reached its peak in February of this year (7.4 percent) but luckily decreased to 6.4 percent in July. The recent trends are promising but the fact remains that Frederick County’s unemployed work force has doubled during the past two years.

Stanford Industrial Park is located approximately seven miles southwest of Frederick City. There are a number of developers and a wide variety of businesses located in this complex, including light retail, warehouse, and warehouse flex. There are a total of 183.57 acres divided among 41 lots that range from 1.71 to 11.26 acres. Approximately 97 acres (22 lots) are currently vacant. The vacant lots represent approximately 53 percent of the industrial park land. In addition, 19 lots have been improved, typically with warehouse/office buildings that have approximately 398,000 square feet of total gross building area. According to information stored in the Maryland Department of Assessment database, approximately 61 percent of the total gross square feet currently under roof in the Stanford Industrial Park was constructed between 2004 and 2008 — during the period of low unemployment and high economic confidence.

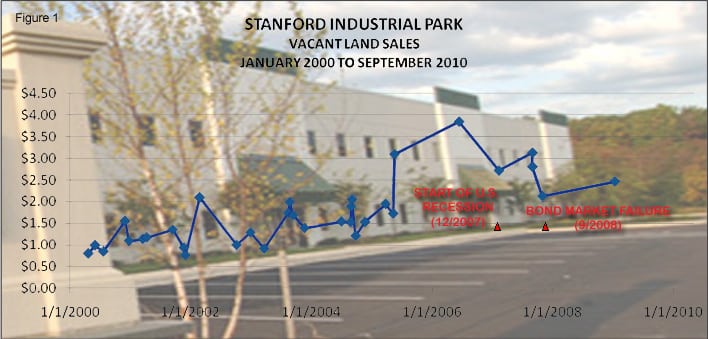

Figure 1 highlights vacant land sales that occurred from January 2000 to the last one that occurred in January 2009. As you will notice, the number of sales per year slowed in the year leading up to the start of the recession (which began in December 2007) and effectively ceased since the bond market failure in September 2008.

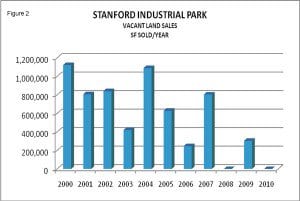

The bar graph (Figure 2) reflects the number of square feet sold each year during the same time period reflected above. Only one vacant land transaction has occurred since December 2007, despite the fact that a considerable amount of land remains vacant within the Stanford Industrial Park and has been available for sale.

These vacant land data reflect a direct correlation between increasing unemployment within Frederick County and rapidly decreasing land values. Decreasing land values increase the investment risk for local real estate developers/investors and places considerable strain on the balance sheets of lending organizations.

It must be pointed out that other factors were present during this time that contributed to the decreased sales of vacant land in the Stanford Industrial Park. These included the existence of competing industrial properties located within Frederick City — Monocacy Boulevard, remaining existing lots on Tilco Drive — as well as lots just outside of Frederick City at McKinney. Market participants noted that several transactions never left the feasibility phase due to site plan impediments that were required by a Frederick County Department of Planning and/or Planning Commission review. The Planning Commission impediments increased considerably after the election in 2006 of the current Board of County Commissioners, causing several proposals to become infeasible. Increasing opportunities for job growth should be the first priority for policy makers in Winchester Hall, Annapolis, and Washington D.C.

Michael P. Pugh is a Certified General Real Estate Appraiser with the Pugh Real Estate Group, LLC., in Frederick, Maryland. He specializes in the appraisal of improved and unimproved commercial and industrial real estate. He is an Associate Member of the Appraisal Institute. Michael is a member of the Rotary Club of Frederick.

Nice blog

Good and informative

Thanks for blogging

Thank you for reading and commenting on our blog. MacRo, Ltd.