Analysis paralysis can have tragic consequences for real estate investors and business owners.

A few years ago, I met with a prospective client whose retail store a decade earlier had been – by all definitions – experiencing success. Everything appeared to be smooth sailing for this to be the vehicle to a comfortable retirement.

A few years ago, I met with a prospective client whose retail store a decade earlier had been – by all definitions – experiencing success. Everything appeared to be smooth sailing for this to be the vehicle to a comfortable retirement.

During those boom years, however, new commercial properties began to pop up a few miles down the road closer to town. Traffic patterns began to change, and his business slowly started to wane.

In order to counter the change in the tides, funds were borrowed to make improvements and step up marketing. Then it seemed within the blink of an eye the bottom fell out of the economy.

The handwriting was on the wall that a recovery could not come too soon.

At the point that I was asked to provide some counsel on the prospect of selling the property and business for a reasonable gain to pay off debt and put the rest away for retirement, the debt-to-value ratio was about breakeven.

We sat together and reviewed the situation inside and out…accountants, lenders and lawyers were brought in … all of whom suggested the business owner sell now.

Unfortunately, it’s been nearly two years and the business is barely covering the cost of inventory and labor. Maybe it’s an issue of pride of ownership or not having an alternate plan, but no decision has been made … other than by the lenders, who have a sense of urgency as they now find their customer in arrears on outstanding debt that exceeds value.

For the small to medium-sized business owner, real estate is not always part of a diversified portfolio of investments acquired as a growth and/or retirement strategy. Instead, many of these investors hold title to the facilities that house their business – be it retail, industrial or agricultural real estate – essentially putting most of their eggs in that one basket.

Investment diversification is essential to survive and prosper through the economic roller coaster one experiences during a business career.

I recently read a quote in the by the late Joseph A. Schumpeter: Capitalism “never can be stationary. . . . The fundamental impulse that sets and keeps the capitalist engine in motion comes from the new consumers, goods, the new methods of production or transportation, the new markets, the new forms of industrial organization that capitalist enterprise creates.”

No investment is truely stationary … consider the tried and true municipal bond market. Who would have ever figured that holding Stockton, California bonds would be anything but safe?

Commercial real estate always does not win or lose value as the sole result of global, national or even regional economic swings. It is usually as simple as the relocation of a road or a new retail center that changes the flow of traffic or brings new competition for products and services.

When severe and unanticipated swings occur in business cycles, many small business people can be caught off guard and forced to rethink an entire business and/or life plan. And in combination with unstable real estate markets – like the one we are presently experiencing –investors often become locked into a state of paralysis by analysis.

More often than not, when a property owner falls into this prolonged indecisive comatose state, more opportunities are lost than could be gained by “waiting it out.”

In a January 2011 post to the MacRo Report Blog entitled Staying Power and Real Estate Investment, I discussed the value of making very difficult decisions in the aftershocks of a real estate bust that appears to be on the verge of a recovery.

If the decision is to wait things out, does the investor have the financial capability and other resources to survive what could be a very long stretch of time? And if so, what will the TRUE cost be – in terms of lost investment opportunities – of tying up capital and paying taxes and expenses during the years or even decades it could take to wait out the market?

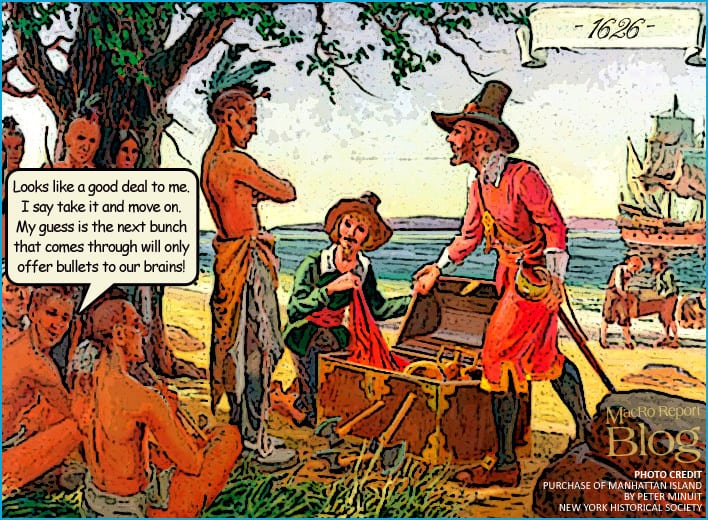

Those of us who follow the land and commercial real estate market (and many who don’t) are aware of the history makers in the business: Donald Trump, Sam Zell and lest we not forget Peter Minuit, who on behalf of the Dutch West India Company in 1626 acquired the island of Manhattan from the Native American Lenape tribe for trade goods valued at 60 guilders … the equivalent of about $1,000 in today’s U.S. dollars.

Success in real estate investing seems to come with varying degrees of dumb luck, market timing and a business savvy that leads to making the right decisions at the right time.

These real estate owners have learned to make their acquisition and sale decisions on sound business principles. Whether it involves a piece of commercial or industrial real estate, a farm or a home, they know that as hard as it is, there is no place for emotions and ego in this process.

In the case of Zell and Trump, real estate ownership is the foundation of a business strategy toward personal wealth and other life goals in our capitalistic economy. They both have had their share of losses, but they know when to move on to something more profitable.

In the case of my paralyzed client, there was an opportunity lost to get out of debt and start over with a new plan.

By holding on he has had to find a new revenue plan (a job away from the business) just to carry this real estate until the market forces of a recovery that will return at least some of the equity he lost … and that may take a while.

Rocky Mackintosh, President, MacRo, Ltd., a Land and Commercial Real Estate firm based in Frederick, Maryland. He is an appointed member of the Frederick County Charter Board. He also writes forTheTentacle.com.