Multifamily and Downtown Mixed-Use properties dominate the product type sold, with the Anson Smith downtown mixed-use portfolio capturing 25% of the number of transactions … and why Springsteen?

Maybe it was the COVID-19 virus that contributed to the significant drop in the average quarterly sales volume and closed transaction tally, but whatever it was that caused the slowdown, it was a big change.

was the COVID-19 virus that contributed to the significant drop in the average quarterly sales volume and closed transaction tally, but whatever it was that caused the slowdown, it was a big change.

Eye Opening Stats

Since Q1 2018, the sales volume of land and commercial real estate transactions and number of closed deals have averaged a startling $126 million with just a tad over 41 per quarter respectively. However, Q2 2020 generated a mere $46.6 million in sales — a whooping fall of 63% with a 13% drop in the number of transactions at 36. If one were to factor in the Anson Smith investment portfolio of 8 properties as one transaction, then the percentage drop in closed deals will have fallen by a factor of 37%. (I’ll get into the details of the Smith sale in a moment)

Statistically, if one were to only look at as noted above, Q2 2020 may seem like even more than a “Debbie Downer.” But when we consider that the two previous quarters of Frederick CRE sales generated sales volume that were two of the top three volume quarters in the last 5 years, there’s a different twist. So, the average of quarterly volume in the last 9 months (Q4 ’19, Q1 ’20 and Q2 ’20) exceeded $169 million.

The general business shutdown that resulted from COVID may very well have delayed the ability to get deals that were written months ago to settlement. Add in the recessionary pressures that were caused by these workplace closures, and it could be better than wishful thinking to hope that the pendulum will swing back soon to that $100 + million quarterly sales volume we in commercial real estate were getting very used to.

Can’t wait to see how this plays out!

The Top Deals of the Quarter

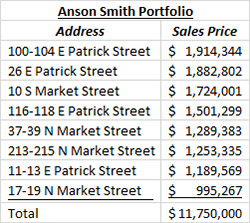

As noted earlier, the late Anson Smith owned a portfolio of eight very prominent downtown Frederick mixed-use properties all located within a block or two of the city’s center, known more intimately to residents as the Square Corner, at the intersection of Patrick and Market Streets. All of the properties were very attractive, well-kept and generally always fully leased. The total of all buildings comprised of just over 96,000 square feet with 50 residential apartments and 13 commercial/retail units. The total tax assessment value approximated $8.6 million. Estimated annual net operating income generated from rental revenues is about $780,000. The package was sold this past May for $11,750,000, equating to a cash on cash investment return of around 6.6%.

earlier, the late Anson Smith owned a portfolio of eight very prominent downtown Frederick mixed-use properties all located within a block or two of the city’s center, known more intimately to residents as the Square Corner, at the intersection of Patrick and Market Streets. All of the properties were very attractive, well-kept and generally always fully leased. The total of all buildings comprised of just over 96,000 square feet with 50 residential apartments and 13 commercial/retail units. The total tax assessment value approximated $8.6 million. Estimated annual net operating income generated from rental revenues is about $780,000. The package was sold this past May for $11,750,000, equating to a cash on cash investment return of around 6.6%.

Anson Smith (1956 –2016) was a resident of Bethesda in Montgomery County, Maryland. He was an accountant, business entrepreneur, and very talented musician. One of his many claims to fame is that he was the business manager for one of Bruce Springsteen’s guitarists for 29 years. He occasionally accompanied the E Street Band on tour.

Mr. Smith’s estate was represented by local CRE Broker Maribeth Visco. Tina Poss, an agent with The Verdant Companies of Frederick, represented the purchaser: The Taft-Mills Group, a subsidiary of Taft Family Ventures, which is a substantial multifamily development and real estate investment firm based out of Greenville, North Carolina. Poss has represented the company in at least one other purchase in the county.

Two other transactions that rounded out the top 3 sales this past quarter were:

- The Apartments at Jefferson Chase located at 501 Prospect Blvd in Frederick sold for a price of $10,500,000 in May 2020. It is an older project that was renovated within the last decade. It contains 31 one-bedroom and 52 two-bedroom apartment units. At last count, it was fully leased.

- Catoctin View Apartments, at 800 Motter Avenue on the north end of the city of Frederick, recently transferred this past June at a price of $7.5 million. The property was sold by The Housing Authority of the City of Frederick. The project is comprised of 100 apartment units, 74% of which are studios and the balance is a mix of one and two-bedroom spaces.

The remaining 26 transactions of the quarter consisted mostly of mixed-use downtown properties, with a spattering of small office, warehouse and one commercial land deal.

What will the CRE market reveal in the coming months?

Frankly, I’m pretty optimistic that a rebound is on the horizon for Q4.

Stay tuned to the MacRo Report Blog.

Rocky Mackintosh, President of MacRo, Ltd., a Land and Commercial Real Estate firm based in Frederick, Maryland, has been an active member of the Frederick community for over four decades. He has served as chairman of the board of Frederick Memorial Hospital and as a member of the Frederick County Charter Board from 2010 to 2012. He currently serves as chairman of the board of Frederick Mutual Insurance Company. Established in 1843, it is one of the longest enduring businesses in Frederick County.