At the halfway point in the year, beyond the fact that there were no mega deals, mixed trends prevail in Frederick County commercial real estate lease deals.

In each of the first halves of 2017 and 2018, there were a few large lease deals (anywhere from 25,000 to 600,000 square feet to one tenant) that skewed the stats in the Frederick County, Maryland CRE market. Without one deal even reaching the 25,000 SF market this time, for the first time in 2 years, quarters one and two of 2019 laid bare those trends and clearly exposed the current state of the market. But the underlying positive theme remained with overall vacancy rates seeking stability and lease rates continuing to steadily increase.

of 2017 and 2018, there were a few large lease deals (anywhere from 25,000 to 600,000 square feet to one tenant) that skewed the stats in the Frederick County, Maryland CRE market. Without one deal even reaching the 25,000 SF market this time, for the first time in 2 years, quarters one and two of 2019 laid bare those trends and clearly exposed the current state of the market. But the underlying positive theme remained with overall vacancy rates seeking stability and lease rates continuing to steadily increase.

Leasing Volume:

Subtracting the nearly 620,000 SF in 2 mega industrial deals in Q’s 1 and 2 of 2018, the first half of 2019 only yielded 92% of all types of leasing activity for the same period last year — 392,500 SF in 2108 compared to 360,300 so far this year.

The same period in 2017 experienced three transactions in excess of 25,000 SF that totaled 132,400 SF, which left 371,000 SF in closed leased deals under the 25K SF mark.

So, 2019 is displaying a trend of fewer and fewer “bread and butter” deals; a volume falling 8% from 2018 and 3% from 2017.

Number and size of deals:

Overall, the number of transactions dropped by 17.27% from first half of 2018, which leased up 110 back then, while only 91 deals were inked so far this year. There is an even greater discrepancy for this year, when one compares the 117 deals signed in the first 180 days of 2017. The good news found in these stats, however, is that the average size of a leased space increased significantly in 3 of the 4 categories tracked.

The retail showed the most significant swings with a drop of 9 deals from last year’s 28 deals, leaving only 19 transactions so far this year. Again, the bright sign here is that the average square feet per unit leased rose nearly 55% from 2,390 SF to 3,700 SF this year. This yielded an increase in total office square footage leased of 3,400 SF to a total of 70,300 SF.

The office market followed a similar trend with a fall off of 12 leases inked from last year’s 51 … so only 39 were signed up. But the average size of leased spaced increased a very respectable 32% from 2018’s 2,350 to 3,111 square feet per unit.

Flex space deals actually increased from 16 leases inked in 2018 to 20 so far this year. The average square footage per unit popped about 12% from 3,900 to 4,375 square feet.

Industrial warehouse space experienced a major drop from those two deals noted above that totaled 620,000 square feet, but even after deducting that whopper from 2018’s warehouse figure, it left another 143,000 square that was absorbed into the market in 13 transactions. The good news for Industrial in this year’s first two quarters is that it logged another 13 inked leases under 25,000 square feet, but the bad news is that it only used up 72,000 square feet … causing average unit size to drop from last year’s 11,000 to 5,530 square feet.

Average Lease Rates:

With the exception of one sector, average lease rates continued to show steady increases.

In keeping with its “against the grain” swings so far this year, the retail market lost ground on the overall trend of climbing rates. At the end of 2018, the average rate was $17.42 per square foot … six months later it fell to $16.99. Several factors come into play here. Considering all sectors, retail rates have the most dramatic range for market rates, where major high-profile shopping centers can command rates as high as $55, other more remote and less appealing retail spaces may lease for a mere $10 per square foot. So, as the old saying goes, it truly is a matter of the three most important words in real estate are “location, location, location!”

The greatest gain in rates since the end of last year happened in the ever tightening flex sector. Average rates topped out at $7.55 by the end of ’18 but really shot up 180 days later to $9.95 per square foot.

The remaining two sectors displayed modest gains. Office averaged $12.85 and warehouse hit $6.50 per square by June 30th of this year, which reflect increases of $0.53 and $0.30 respectively since last year’s end.

Vacancy and Absorption Rates:

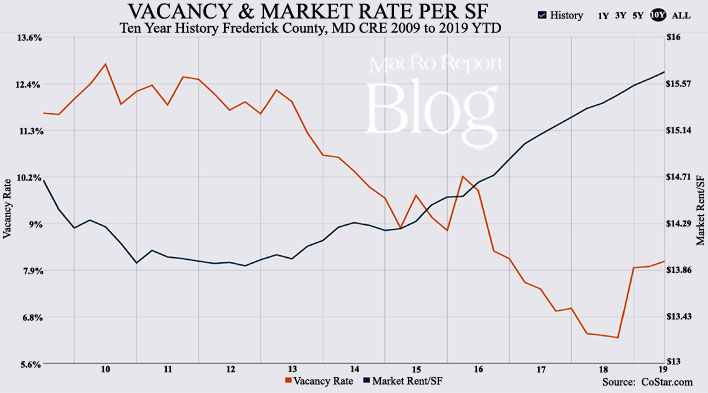

Stepping back and looking at the big picture of the last ten years, as can be seen in the image this post displays, the first 6 months of 2019 stayed right on track with overall steady increases in market lease rates.

The trend in the declining vacancy rates from the 2010 peak of nearly 13% found its way to a new low of close to 6% by the 3rd quarter of last year, but with a steady flow of new deliveries absorbed into the market over the last 3 years, a net negative absorption of 700,000 square feet space hit in the 4th quarter, pushing vacancy rates back in at around 8%, where it has sat since.

In summary, the first two quarters of ’19 started off with less volume than in past half years but, at the same time, kept with the trend of rising average lease rates.

[Author’s note: all data used in this post was gathered from statistics provided by CoStar – www.costar.com]

Rocky Mackintosh, President of MacRo, Ltd., a Land and Commercial Real Estate firm based in Frederick, Maryland, has been an active member of the Frederick community for over four decades. He has served as chairman of the board of Frederick Memorial Hospital and as a member of the Frederick County Charter Board from 2010 to 2012. He currently serves as chairman of the board of Frederick Mutual Insurance Company. Established in 1843, it is one of the longest enduring businesses in Frederick County.