Market statistics show positive improvements in all sectors of residential and commercial real estate.

It seems that Frederick is well positioned for continued gains and drops in the right places at the dawn of 2017.

seems that Frederick is well positioned for continued gains and drops in the right places at the dawn of 2017.

It was November 22, 2016, just two weeks after the U.S. general elections, and the surprising results that put the Republican Party at the helm of all three branches of government were still hard for many to accept. The local legal office of Miles & Stockbridge, P.A. held for many of their clients a “Breakfast Briefing” on the state of the local real estate market at Dutch’s Daughter Restaurant. The speaker was Anirban Basu, a nationally known economist based in Baltimore, who represents the Maryland Bankers Association, as well as any number of homebuilding, real estate and other business groups.

Mr. Basu, who also spoke to the Maryland Bankers earlier this month along with a number of other well-known economists, recently confirmed much of what he originally forecasted at the Miles & Stockbridge, P.A. sponsored briefing in November.

It was at the Miles & Stockbridge presentation where Basu initially forecasted good things for Frederick County.

In a nutshell, Basu foresees the 2020’s as a period of “massive economic growth in Frederick.”

Let’s break down the statistics that support his claim:

Residential Real Estate

Home Ownership:

Frederick County housing values and volume have been steadily rising since the depth of the recession. According to statistics from the Maryland Association of Realtors:

Frederick County housing values and volume have been steadily rising since the depth of the recession. According to statistics from the Maryland Association of Realtors:

- The median sales price for a home has increased by 19% from a low of $228,250 in December 2011 to $272,302 in December 2016. This includes a 1.98% increase from 2015 to 2016.

- Housing units sold have increased by 63% during the same 5-year period from 2,516 to 4,307. The difference between 2015 and 2016 was a whopping 10.59%.

- Available inventory in the past year dropped significantly by 27% from 1,286 units on the market to 939 units – now under a 4 month of supply … meaning as demand is increasing, the supply is falling, which will give cause for increasing prices, and, if the trend continues, hopefully more new home starts.

- The Maryland Department of Commerce estimates that the largest segment of the county’s population (as of 12/15: 31.6% or 77,500) is the 22 to 44 age group. They are buying houses … and within that group is the millennial generation, which is on the cusp of settling down and making commitments.

Multifamily Housing:

The rental apartment market has been growing and rents have been rising. This is based upon current statistics garnered from CoStar Property® for the multifamily market, as well as the other commercial sectors below:

- There are currently 10,337 multifamily units in Frederick County, with the five-year average running at 9,639. So, the number of units has been increasing steadily in the last few years.

- With the increasing supply of apartments, vacancy rates have increased slightly from a five-year average of 6.0% to today’s 7.7%, which is verified by the fact the absorption rate has stayed steady at around 195 units per year for the last half decade.

- The per square foot average of monthly rental rates peaked at $1.30 midway through 2016, took a few cent dip in the late summer and ended the year at around $1.29. These are significant increases over the 2012 rate of $1.14 per square foot.

- And about 314 new units came online last year.

Commercial Real Estate

Office:

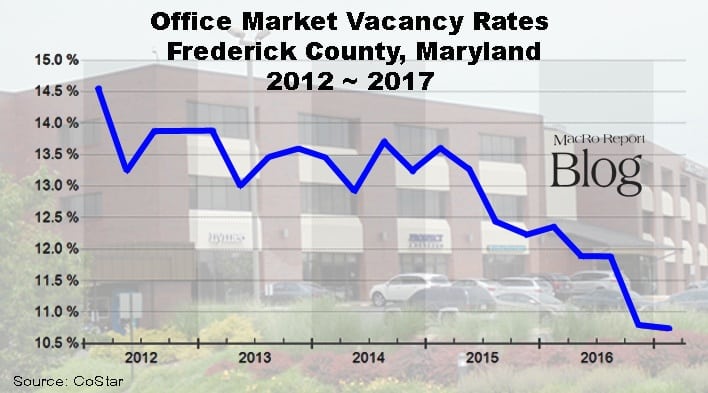

Since the end of the first quarter of 2015, things are progressively getting better for this sector. Consider the following:

- Within Frederick County there are 656 buildings containing 8,884,310 square feet of leasable space. This figure is about 1.4% above the five-year average. In other words, practically no new buildings have come online during the recession and recovery.

- It was sometime in March of 2015 that the vacancy peaked for about the fifth time between 13.5% and 14.0%. In the succeeding 21 months and now into the early weeks of 2017 vacancy rates have plummeted to 10.7%, leaving just less than one million square feet available to lease.

- As the vacancy rates are falling, this sector is also experiencing an increase in the average gross lease asking rate — up from the five-year average of $20.90 to $21.36 per square foot … and the average absorption rate has fallen to 20.7 months on the market – still high, but declining.

Warehouse/Flex:

As ecommerce is taking a chunk out of hard retail space, the warehouse and flex market has really been experiencing very positive gains in Frederick.

- Out of the 19,245,678 square feet, about 708,000 newly constructed space came on the market in 2016, which made up about 50% of the space available.

- Vacancy rates have fallen from 16% in the depths of the recession to a current 7.9%. When new products came on online in the early-to-mid 2016, there was a temporary bump that disrupted the steadily decreasing trend line, but once absorbed, the trend continued.

- Lease rates on average have increased about 6.7% from the 5-year range of $7.25 per square foot to $7.74.

Retail:

There’s a mixed bag of reviews on the status of commercial real estate’s retail sector in Frederick County, Maryland:

- With nearly 13 million square feet of leasable space in the county, the vacancy rate has steadily increased from below 6% in early 2012 to a high of about 8.25% in mid-2016. Presently the rate is 7.9%.

- While the five-year average of new building deliveries has been running around 81,000 square feet, less than 30,000 square feet made it to prime time in 2016.

- The average lease rate asking price per square foot for space in late 2012 was $16.90. It steadily rose to over $19.00 per square foot in early 2015, but fell again in 2016 to just over $17.50.

- Over the last 5 years the absorption rate has averaged a negative 3,800 square feet. However, last year that figure fell to a minus 17,774 square feet.

All in, Basu stated that the Frederick market is well positioned to take advantage of the growing millennial market.

“The most common age in America is 24,” he says. This generation is and will be attracted to the amenities that Frederick possesses – a culturally rich downtown, easy access to two major metropolitan areas, good schools, safe neighborhoods, affordable housing opportunities for the younger and new family market and a growing job market.

Speaking of jobs, as of the end of the 3rd quarter of last year, Frederick enjoyed a 3.6% unemployment rate, which as Basu said effectively equates to full employment. The trajectory for the county’s unemployment appears to be a “nice smooth gradual decline.”

It seems that there are many arrows pointing to strong economic growth in Frederick County. Basu summed up his presentation stating that the key to providing sustained growth in Frederick County will be to provide quality schools, maintaining a variety of available housing stock and managing traffic.

That, states Basu, is the formula which will draw employers to the county to fill the deep well of available office space. He says employers always follow the growth of young families.

Note to Mayor Randy McClement and County Executive Jan Gardner: The key to sustained economic prosperity for Frederick County is a steady supply of new housing stock.

Rocky Mackintosh, President, MacRo, Ltd., a Land and Commercial Real Estate firm based in Frederick, Maryland. He has been an active member of the Frederick, Maryland community for over four decades. He has served as chairman of the board of Frederick Memorial Hospital and as a member of the Frederick County Charter Board from 2010 to 2012. He currently serves as chairman of the board of Frederick Mutual Insurance Company. Established in 1843, it is one of the longest enduring businesses in Frederick County.