With only a few exceptions, the US economy appears to be headed for another year of positive growth!

Once again, my new year kicked off with an invitation to attend the Annual Maryland Bankers’ Association First Friday Economic Forum in Baltimore. My gracious host was the dynamic team of the new leadership at Woodsboro Bank. I can’t give enough thanks to President & CEO, Steve Heine, Vice President of Business Development, Mary Barry, and Senior Vice President and Chief Lending Officer, Richard Ohnmacht, for their hospitality. It truly is an annual highlight of the year to kick off each year with an opportunity to hear some of the region’s best provide their forecasts for the next 12 to 18 months.

new year kicked off with an invitation to attend the Annual Maryland Bankers’ Association First Friday Economic Forum in Baltimore. My gracious host was the dynamic team of the new leadership at Woodsboro Bank. I can’t give enough thanks to President & CEO, Steve Heine, Vice President of Business Development, Mary Barry, and Senior Vice President and Chief Lending Officer, Richard Ohnmacht, for their hospitality. It truly is an annual highlight of the year to kick off each year with an opportunity to hear some of the region’s best provide their forecasts for the next 12 to 18 months.

Once again, MBA brought a highly respected panel of experts to the forum. As usual the master of ceremonies was the always entertaining and highly regarded Anirban Basu, Chairman & CEO of the Sage Policy Group, Inc., from Baltimore. The Keynote speaker was Thomas I. Barkin, President and CEO of the Federal Reverse Bank of Richmond.

Other panelists and speakers included:

- Mark McGlone, Chief Investment Officer of PNC Asset Management Group

- Luke Tilley, Chief Economist for Wilmington Trust Investment Advisors

- Andrew Richman, Managing Director, Fixed Income Strategies and Senior Vice President for Sun Trust Advisory Services, Inc.

Over the last several years, a variety of guests have brought similar forecasts, but very often they found sometimes strong differences of opinion for the outlook for the year ahead, especially for the third and fourth quarters. However, at last year’s event, these guests seemed much more aligned than in the past. And for this the 13th annual event, it was almost disturbing how all believed that at the dawn of this new decade very positive outlooks were predicted by all. Outside of this distinguished group, many other leading national economic gurus have been offering up very similar opinions.

Along with insights from a few other of my favorite sources (Wall Street Journal, The Kiplinger Letter and James Glassman, Head Economist, Commercial Banking for JP Morgan/Chase), here is summation of the insights of experts:

Recession on the Horizon?

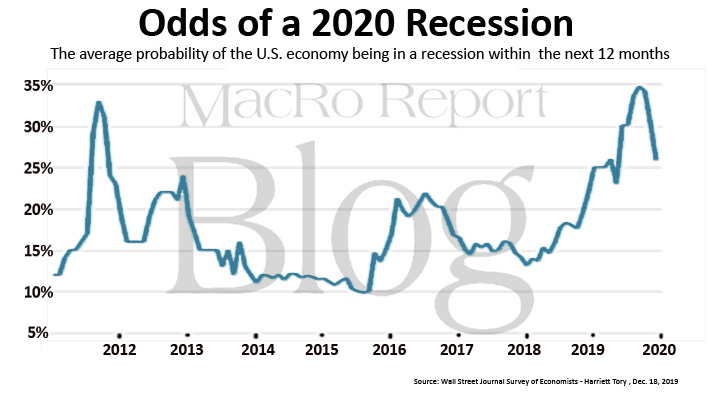

- Basu is optimistic about the 2020 economy. He states while there was a reasonable amount negativity reflected from the media and forecasters in 2019, as well as in financial market volatility, just because people believe a recession is eminent; that does not necessarily mean that one is just around the corner.

- In a December 2019 Wall Street Journal survey of several leading economists, this group saw an average probability of a recession in the next 12 months fall to 25.9%, down from 30.2% in November and 34.2% in October.

- Sun Trust’s Richman sees this year enjoying “a slightly better global economic growth environment, but modest capital market returns relative to the stellar gains of 2019.”

- Barkin states that “several leading indicators point to continued economic growth, including consumer confidence, consumer spending and initial claims for unemployment insurance.”

- Glassman: “At the top of the business cycle, the economy is unexpectedly tranquil as tame inflation and low interest rates create favorable tailwinds.”

- Kiplinger: “Recession is unlikely, barring some shock like war, a terrorist attack, a natural disaster, etc.”

Productivity

- Wilmington Trust’s Tilley continues “to expect measured productivity to move higher through the present expansion and into the next one … higher future productivity is a key tailwind for the global economy that could serve to lengthen the economic cycle, boost corporate profits, and enable a ‘virtuous cycle’ between profit growth and consumer income.”

- Barkin offers “… the economy can only grow as quickly as workforce growth plus productivity growth. Productivity growth averaged just 1 percent between 2013 and 2018. Over the same period, workforce growth averaged 0.8 percent. Adding these up, we’d predict GDP growth of around 2 percent—which is right where we are. To me, the current numbers suggest we’re converging to normal levels rather than underperforming.”

- Barkin adds further: “… faster GDP growth … requires boosting productivity growth or increasing the size of the workforce. To achieve the latter, we need to either draw people off the sidelines of the labor force or increase immigration, which has contributed to about half of workforce growth since the 1990s.”

Financial Bubbles

- Tilley does not see any on the horizon. The usual suspects (i) Consumer Balance Sheets — in good shape, (ii) Home Prices — only just surpassed the prior cycle’s peak in 2018, and (iii) Interest Rates – they are low and pose little threat to corporate debt levels (though this is one area that gives Wilmington Trust pause).

- Barkin gives a history of recessionary bubbles over the last 40 years: “In the early 1980s, the Fed’s policies to tame runaway inflation caused two recessions back-to-back. A decade later, the savings and loan crisis and an oil price shock led to the 1991 recession. The dot-com bust and the tragedy of Sept. 11 precipitated the recession in 2001, and the subprime mortgage crisis and ensuing financial meltdown created the Great Recession in 2007-09. None of these were a situation where we gradually drifted into a recession—to find one like that you’d have to go back to the 1970s.”

Labor Force/Unemployment

-

- Wall Street Journal (12/18/19): “… the labor-force participation rate rising slightly to 63.5% on average at the end of 2020 and 63.6% at the end of 2021. The rate, which accounts for workers who are employed or actively seeking employment, was 63.2% in November.”

- Basu says that while demand for new construction is strong, the industry is still seeing the effects of the labor shortage.

- Kiplinger: “The jobless rate [is] staying low. Job growth is likely to slow to about 160,000 new jobs monthly, down slightly from 180,000 per month last year. There simply aren’t enough qualified workers to hire.”

- Glassman: “Some contend globalization is a threat to American workers, but labor demand currently outpaces supply due, in part, to new opportunities created by international expansion.”

- Barkin on unemployment:

-

- “… the labor market is very strong. The unemployment rate was 3.5 percent in November—the lowest rate since 1969.”

- “There are about 1 million more job openings than job seekers. Consequently, we’re seeing employers willing to take a chance on people they might have passed over a few years ago.”

- “… earnings have increased 3.1 percent over the past 12 months and even more for lower-paying jobs.”

- “unemployment insurance … claims are near a 50-year low even though the labor force is larger than ever.”

-

Trade

- Wilmington Trust: “…it is a trade policy (as opposed to a monetary policy) misstep that poses the most imminent threat to the current cycle.”

- Kiplinger: “Uncertainty about trade will linger, as China and the U.S. are still far apart on a comprehensive, long-term trade deal. New frictions with the European Union are possible. So, many businesses that rely on imports or exports will stay cautious.”

- Barkin: “… trade actions and trade uncertainty, regulatory changes and regulatory uncertainty, geopolitical challenges and domestic politics. In my view, the biggest boost to our economy would come from lessening the uncertainty and lowering the volume.”

There are so many more talking points to cover, not to mention the inverted yield curve, the upcoming US Presidential election, the true strength of the stock and bond markets, and the global trend toward trend toward protectionism. In general, none of these economic soothsayers believe that any of these are clear and present danger to the current steady level of expansion that we are currently experiencing … at least for the next 12 to 18 months.

In sum, Tom Barkin offered one of the most memorable and least known facts about the durability of economic expansions:

I would note that recession isn’t inevitable. Australia has gone 27 years without one. Or another way to say that is that a policymaker, like me, is still allowed to dream!

Rocky Mackintosh, President of MacRo, Ltd., a Land and Commercial Real Estate firm based in Frederick, Maryland, has been an active member of the Frederick community for over four decades. He has served as chairman of the board of Frederick Memorial Hospital and as a member of the Frederick County Charter Board from 2010 to 2012. He currently serves as chairman of the board of Frederick Mutual Insurance Company. Established in 1843, it is one of the longest enduring businesses in Frederick County.

Thanks, Rocky! Really appreciate the well-organized summary.

I’ll sleep better – at least for the next 12 -18 months!

Craig

Thanks, Craig!