Flex vacancies declined and interest in the Golden Mile picked up during 2014.

CoStar reported 200 commercial lease transactions in Frederick County last year. In terms of the number of deals, office was the big winner with 80 of those transactions—good news for a segment of the market that is in the throes of a seismic shift nationwide. The industrial segment had the fewest number of transactions (34) but by far the largest number of square feet leased, which is typical for industrial given the type of use.

CoStar reported 200 commercial lease transactions in Frederick County last year. In terms of the number of deals, office was the big winner with 80 of those transactions—good news for a segment of the market that is in the throes of a seismic shift nationwide. The industrial segment had the fewest number of transactions (34) but by far the largest number of square feet leased, which is typical for industrial given the type of use.

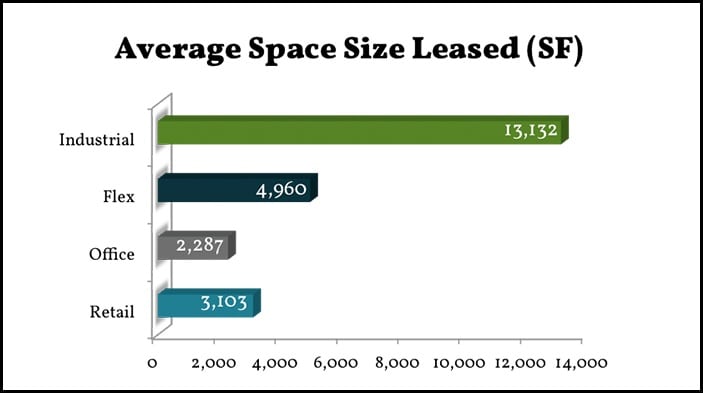

In terms of the size of the users, just as we reported last week it’s consistently small businesses that have come off the fence and are actively leasing across all segments of Frederick’s commercial real estate market. The graph below shows the break out of segments by average space sized leased.

I was pleasantly surprised to see that nearly 40% of the retail deals done last year were on the Golden Mile. (There were 50 retail lease transactions in Frederick County last year, and 19 of them were in strip centers on the Golden Mile).

I was pleasantly surprised to see that nearly 40% of the retail deals done last year were on the Golden Mile. (There were 50 retail lease transactions in Frederick County last year, and 19 of them were in strip centers on the Golden Mile).

While the west side of town is considered “in transition” due to shifting demographics and the dated condition of many key retail properties, it is nonetheless a very active community. Businesses (both local and out of town) that serve the demographic niches settling in neighborhoods within walking distance to the Golden Mile area are recognizing the potential of that market. Retail vacancy rates hover around 6.5% in that area (not including Frederick Towne Mall), which is very healthy. It remains to be seen how Walmart will shape future improvements and development of the West Patrick corridor.

Another pleasant surprise is the realization that St. John Properties has whittled their vacancy rates down to low single digits; just two years ago they were facing down the barrel of ¼ million square feet of vacant flex space in business parks that were approved and built near the height of the market. Filling those vacancies has taken considerable pressure off Frederick’s flex market (indeed vacancies for flex dropped by about 6% from two years ago), and the ripple effect will no doubt help the local office market as well.

Following is the top lease deal for each commercial real estate segment in Frederick last year:

Office – 17,930 SF

The American Association for Laboratory Accreditation leased 17,930 square feet at the Westview Corporate Campus on Presidents Court during the second quarter last year. The lease term is reported as 5 years, and the lease rate is reported as $20.50 per square foot full service (CoStar generally estimates those rates).

Retail – 40,484 SF

Wolf’s Furniture opened an outlet store at Ballenger Creek Plaza last year, leasing 40,484 square feet during the second quarter. No information was given regarding lease term or rates.

Industrial – 60,000 SF

Intelligrated Systems leased 60,000 square feet of space at Wedgewood South on Buckeystown Pike. No information was available on the lease term, but the rate is reported to be $6.90 per square foot triple net.

Flex – 12,840 SF

Knight Sky leased 12,840 of flex space at St. John Properties’ Westview Business Park on Pegasus Court. No further information on the deal was available.

Interested in staying on top of the Frederick Real Estate market? Subscribe to the MacRo Report blog.

About the Author: Kathy Krach is a Vice President of Commercial Sales and Leasing at MacRo, Ltd., a Land and Commercial Real Estate firm based in Frederick, Maryland.

*Data used for this article and graph was gathered from CoStar, the nation’s leading provider of commercial real estate trends and intelligence. The information is deemed to be reliable, although MacRo has not independently verified it and does not guarantee that it is correct.