Not a great year ahead, but who’s complaining this year will be a good one … but maybe as good as it gets!

How’s Business?

Through my networking and interaction with fellow local and regional business people, very often the conversation starter is the question, “How’s business?” Over the last six years of a very slow national economic recovery, that lead query is immediately tagged with, “You staying busy?”

Through my networking and interaction with fellow local and regional business people, very often the conversation starter is the question, “How’s business?” Over the last six years of a very slow national economic recovery, that lead query is immediately tagged with, “You staying busy?”

My guess is that the latter evolved out of concern that if the answer to the first question is negative (or too hard to spit out), at least an acknowledgement of being “busy” can garner a positive response.

But while the two seem to go hand and hand now, the answer in recent years to “How’s business?” has steadily grown to strong positives from those I meet.

I know here at MacRo, Ltd., our business has experienced some of its best years in a long while (including 2015). And as for being “busy,” well yes, our increased “busy-ness” has resulted in positive outcomes for our clients.

So, if you see a spring in this business person’s step every once in a while … you’ll know why.

Economic Health of US Counties

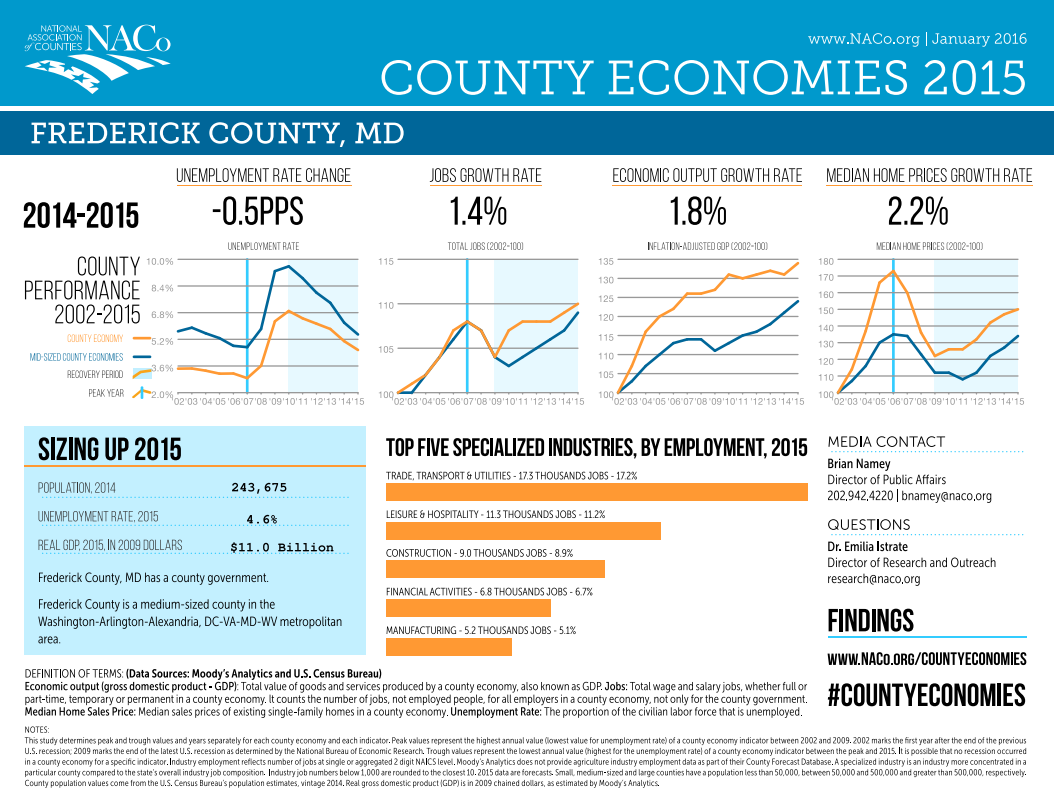

Just this week the National Association of Counties, known as NACo, released Issue 5 of its Trends and Analysis Series which tracks “the performance of the 3,069 county economies in 2015 by examining” the four key indicators of annual changes in jobs, unemployment rate, economic output (GDP) and median home prices. It also studied the “wage dynamics in 2014 and between 2009 and 2014.”

Here are five key takeaways from the study:

- The recovery accelerated in 2015 on unemployment rates and home prices.

- Most county economies grew in 2015, but economic output (GDP) expansion was less pronounced.

- Economic recovery is spreading out.

- Wages increased between 2013 and 2014, especially in large county economies.

- The recovery is creating an uneven geography of opportunity across county economies.

How did Frederick County fare in the NACo study?

Actually not too bad compared to other mid-sized US counties.

The unemployment rate dropped from 5.1% in 2014 to 4.6% in 2015, but is still not fully recovered to pre-recessionary levels of 2009.

The unemployment rate dropped from 5.1% in 2014 to 4.6% in 2015, but is still not fully recovered to pre-recessionary levels of 2009.- Our jobs growth rate increased by 1.4%, compared to 2.04% in 2014, but experienced a decline in real wage growth.

- The economic output rate (GDP) creeped up by 1.8%

- Median home price growth rate increased by 2.2%, but is still not fully recovered to pre-recessionary levels.

Modest gains at best, but being a county in Maryland, Frederick has generally outpaced the average of all other counties in the state.

Economist Anirban Basu, Chairman and CEO of the Sage Policy Group in Baltimore, has spoken recently about how Maryland continues to struggle to just get back to “average” in its national economic rankings.

In my informal survey of Frederick County’s business community most of its leaders were generally pleased with the increased pace of activity in their respective markets in 2015. The sense I get is that this hopefully optimistic mood will realize continued positive improvements through this year, but what are the guru’s saying?

Steady growth ahead

As one of the state’s most sought after economic speakers and advisors, Basu foresees a modest 2% growth rate in 2016, and says that “slow wage growth continues to hold back improvement.”

The good national jobs report for December 2015 was reassuring to many observers with seeing it as a foundation for a sustainable recovery. However, others express concerns that the numbers mask the fact that the labor force participation rate of 62.6% remains at all-time lows. Robert Doar with the Wall Street Journal penned a good article earlier this week, entitled The Big but Hidden U.S. Jobs Problem that is worth a read.

According the Kiplinger Washington Editors the engine that moves two thirds of economic activity in the U.S. is consumer spending. In their December 2015 publications, they predicted that while the year ahead will be “good … not a great one,” they see consumer confidence “staying high.” This provides a platform for more spending as the editors “expect credit card balances to keep climbing as lenders relax their standards from strict criteria put in place after the recession.” This will contribute to continued growth in the housing market, which is still waiting for Generation Y (aka, the Millennials) to move from their current quarters (parents’ basements and apartments) and start buying houses and cars.

This week’s U.S. stock market volatility over how low oil prices, Middle Eastern unrest and troubled economies around the world, among other uncertainties, has raised concerns over how long this recovery will last.

The recent turmoil in the world with slumping economies in Europe, Russia and China is strengthening the U.S. Dollar to the point that is dampening the growth of our industrial (manufacturing) sector, states Kiplinger. But with it being only a 12% share of the GDP and a mere 9% of the nation’s jobs, this alone should not hold back the foreseen positives from dominating in 2016.

Frederick 2016

Most of the positive predictions for continued national growth will be felt in Frederick County. Aside from federal sequestration concerns that loom large in coming years, 2016 should feel much like last year. The added benefit that contributes to the county’s economic engine is the fact that Frederick is a true community at its core.

People want to live, raise a family, socialize and even retire here. So while the nation’s counties continue to seek improvement in jobs, gross domestic product and home prices to the point that they can declare they have emerged from the last recession, Frederick should feel comfortable that this year will be a good one … let’s just say — like it or not — as Good as It’s Going to Get!

What would lay the foundation for greater years ahead for Frederick County?

How about we start with getting our Frederick County Delegation in Annapolis to present and fully support a bill before the General Assembly that will provide authority to the Maryland Stadium Authority to participate in the Downtown Frederick Hotel & Conference Center project?

… and that is the topic of the MacRo Report Blog’s post on January 28th!