It remains one of the most significant unanswered questions in the campaign for Frederick’s first County Executive.

If elected, will Gardner increase county taxes in order to comply with the O’Malley and Brown “Rain Tax”?

If elected, will Gardner increase county taxes in order to comply with the O’Malley and Brown “Rain Tax”?

As the race between Blaine Young and Jan Gardner now enters its final 60 days, the former county commissioner president and Martin O’Malley supporter may very well be hard pressed to avoid answering this question.

For those Frederick County residents who don’t pay attention to their real estate property tax bills each year, well, I guess this article is not worth reading any further.

However, for those who do, you may be fully aware of the fearless challenge that current board President Young has been waging with the O’Malley administration the last couple of years over how Frederick County will comply with HB 987 or the Stormwater Management-Watershed and Restoration Program(affectionately known as the “Rain Tax”). This bill was passed by the Maryland state legislature and became law on May 2, 2012.

There are not too many Marylanders who haven’t heard of the “Rain Tax.” But what is it, and why should Frederick County residents even care?

In the depths of the Great Recession a tax is born

It was back in 2010 Environmental Protection Agency (EPA) put out one its many mandates targeting the reduction of pollution levels in the Chesapeake Bay – essentially requiring a tax on all impervious surfaces. This $7.7 billion clean-up plan was meant to require that the seven states (Figure A) whose rainwater runoff ends up in the Bay were to pro-rationally share in this effort.

Of all those states, only Governor Martin O’Malley of Maryland chose to comply … and of course his Democratic state legislature fell in lock step with his wishes, as been the case with the 40 new taxes that he has signed into law “since he took office in 2007,” according the Forbes Magazine.

And the “Rain Tax” has been labeled the “most oppressive” of O’Malley’s edicts by Travis H. Brown, a contributor to the publication.

Fall in line or else?

Ten of the twenty-four counties in the state are located within the watershed of the Chesapeake. Frederick County chose not to ask the residents and businesses within their jurisdictions to bear the burden by paying additional taxes to cover the costs of Maryland’s share. While O’Malley acolytes protested, the Young board chose not to comply with the intent of the law by only placing a fee of one cent on all county real estate property tax bills. Through savvy budgeting, they found a way to take from the county’s general fund the $4 million this year allowing it to avoid the $10,000 per day penalty for non-compliance.

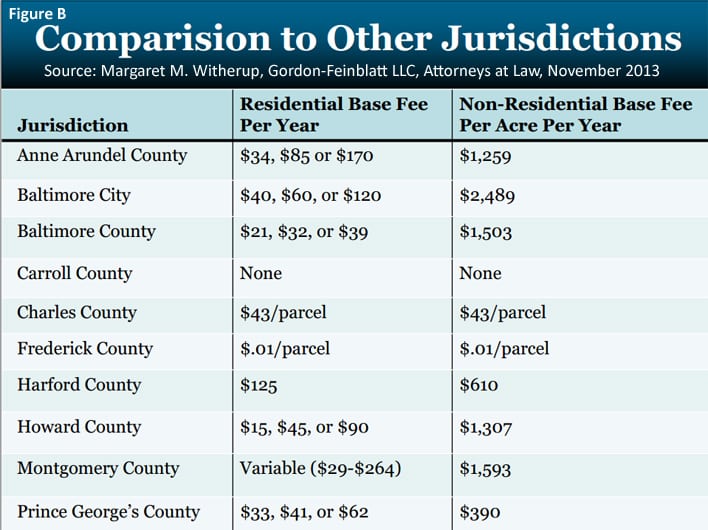

Neighboring Carroll County, another nay-sayer, negotiated with the state to meet their obligations in the same manner without levying taxes on its property owners. All other counties chose to extract more revenue from taxpayers through increased real estate taxes as noted in  Figure B (compliments of a presentation made by Gordon-Feinblatt LLC, Attorneys at Law in November 2013).

Figure B (compliments of a presentation made by Gordon-Feinblatt LLC, Attorneys at Law in November 2013).

Within Frederick County each municipality that has planned services is required to comply with the mandate as well. For example the City of Frederick chose to comply by levying a fee based upon a property’s impervious surfaces. So, if you are a city resident, you will find your Rain Tax noted as a “Stormwater Management Fee” on your water bill.

With Frederick County being faced with an escalating annual compliance obligation that could reach as high as $22.5 million in a few years (that’s equivalent to 5% of the current County budget, mind you), Young has not made a secret of the fact that he has been working to position Frederick County to challenge the state and the EPA in court over the inequity of HB987. Other counties have expressed interest in challenging the law as well.

Commissioner Paul Smith, who is now running for a Maryland House seat in District 3A has written often about the burdens of the Stormwater Management-Watershed and Restoration Program, has warned that at some point Frederick County may not be able to carry the burden through from the general fund alone. With pledges of not raising taxes on its citizens, Smith and Young both believe that the county may not be able to avoid a possible average annual assessment of as much as $500 or more on every real estate property tax bill as the EPA mandated county obligations rise.

Creating Losers

The Rain Tax as a campaign issue has already caused a few casualties in state primaries. The once popular and considered hard to beat councilman Dick Ladd an Republican from the 5th district of Anne Arundel County was defeated in June in a heated race. Ladd was a strong advocate of the Rain Tax and supported taxing his constituents to cover the costs. He lost in a close race.

This brings me back to county executive hopeful Jan Gardner. Again, isn’t it fair to ask: If elected, how will she address the Rain Tax?

Facts are …

Clearly, she has been a steadfast supporter of Martin O’Malley and surely will bow to Anthony Brown’s wishes if he is elected as another Democratic governor of Maryland. In addition while I don’t think thatFrederick News Post has necessarily provided nonpartisan coverage of the Gardner/Young race, I do think that reporter Bethany Rogers did get her “Fact Checking” right in at least one claim that GardnerRepeatedly raised taxes on families in her Head to Head piece posted on August 25, 2014, which validated her record of consistently increasing the tax burden on Frederick citizens between 2000 and 2004 while she sat as a Frederick County Commissioner.

Is it realistic to expect that if Gardner is elected that she will follow Young’s path of bucking Maryland’s commitment to the EPA mandate, or will she not want to ruffle the feathers of the state’s Democratic taxing machine?

Personally, I like Jan Gardner, and I have enjoyed chatting with her over a cup of coffee several times since she entered politics over a decade ago. But as a potential future leader of our community, I truly question whether she has the intestinal fortitude to do anything other than fall in line with the Annapolis establishment and carry buckets full of Rain Tax revenue to the steps of the state capital.

That means Frederick County property taxes will likely increase without hesitation, if she achieves victory in November.

What do you think?

I welcome feedback from our readers on this serious topic.

The author: Rocky Mackintosh, President, MacRo, Ltd., a Land and Commercial Real Estate firm based in Frederick, Maryland. He has been an active member of the Frederick, Maryland community for over four decades. He has served as chairman of the board of Frederick Memorial Hospital and as a member of the Frederick County Charter Board from 2010 to 2012, to name a few.