Six months ago the closed sales volume for building lots in Frederick County finally showed a modest upturn from the great recession; but now things are even brighter!

In the spring issue, I wrote that the market for building lots was finally experiencing a modest upturn from the great recession. The number of transactions was increasing, and it appeared that prices had stabilized. In this article, I’m taking a broader view and looking at ALL land transactions as reported by the local multiple listing service (MRIS) over the past 15 years. Since we only have data for the fist eight months of 2014, I used that same eight month period for each year.

In the spring issue, I wrote that the market for building lots was finally experiencing a modest upturn from the great recession. The number of transactions was increasing, and it appeared that prices had stabilized. In this article, I’m taking a broader view and looking at ALL land transactions as reported by the local multiple listing service (MRIS) over the past 15 years. Since we only have data for the fist eight months of 2014, I used that same eight month period for each year.

I discovered that between 2000 and 2006, the number of transactions was essentially flat; then from 2006 to 2009 the number of sales dropped to less than 25% of that experienced during the peak years of 2004-2006. Between 2010 and 2013, sales rose steadily but were still less than 50% of the peak year. The good news: over the first 8 months of 2014 the number of sales is double what took place in 2010, 2011 or 2012.

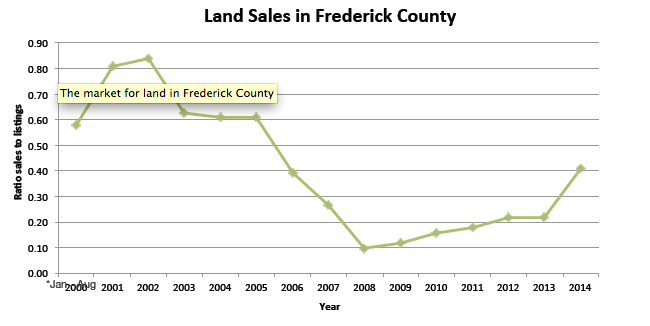

Another interesting way to look at this market is to compare the number of properties sold with the number of listings added. I used a ratio of “solds” divided by “listings added.” When the market is strong (lots of sales compared to listings added), the ratio will be high. When the market is weak the ratio will be low. Here’s graph showing that relationship over the past 15 years:

While this is a simplistic analysis of the market, especially since prices are not considered, the results are revealing. The graph shows a pronounced downturn from 2005 to 2008. In 2009, the “freefall” ended and the market leveled off, improving modestly over the next 5 years. In 2014, the ratio jumped substantially. Hopefully this is a sign of good things to come.

While this is a simplistic analysis of the market, especially since prices are not considered, the results are revealing. The graph shows a pronounced downturn from 2005 to 2008. In 2009, the “freefall” ended and the market leveled off, improving modestly over the next 5 years. In 2014, the ratio jumped substantially. Hopefully this is a sign of good things to come.

From a buyer’s perspective, this is a great time to buy. Prices are still near the low point in the cycle and interest rates are barely about historical lows. For sellers, it’s a little more challenging. The loss in market value from the “unrealistic” peak is substantial and the recovery is slow so far. Land that sells is either aggressively priced or has special attributes that can’t be found elsewhere. “Testing the market” at a high list price just isn’t working; improving the properting to reduce or eliminate buyer uncertainty and risk is essential.

If you’re considering buying, selling or developing land, please feel free to give me a call to discuss your options.

Contact Dave Wilkinson at 301-698-9696 ext. 205 or dave@macroltd.com.