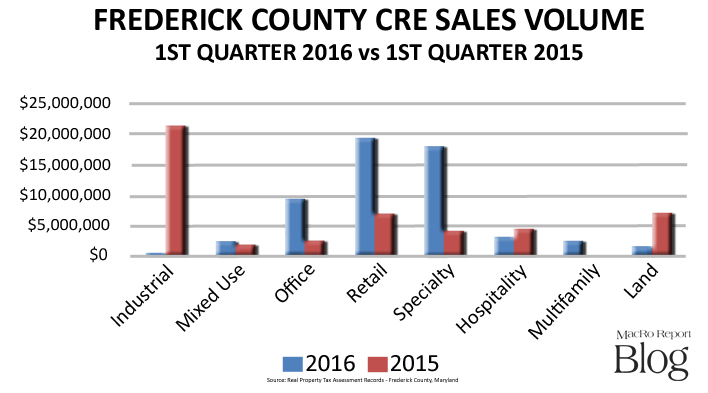

Sales volume reveals a very different sector mix than 2015, but some things are very much the same.

On the surface the sum total of the first quarter CRE sales activity for 2016 appears to be a mirror image of the previous year with exactly 38 closed transactions in the first three months of the last two years.

On the surface the sum total of the first quarter CRE sales activity for 2016 appears to be a mirror image of the previous year with exactly 38 closed transactions in the first three months of the last two years.

The good news is found in the differences. The total dollar volume of arm’s length deals in 2016 exceeded that of 2015 by a factor of 19% with $56.9 million over $47.8 million in 2015.

And there are even fewer similarities found when comparing the activity in the various sectors:

Industrial Property

Only two modest flex/warehouse sales closed in the early months of 2016. Both along the Buckeystown Pike corridor near Exit 31 on I-270, one on Metropolitan Court and another on Industry Lane averaged less than 2,000 square feet and about $205/SF in price.

Compare this to first quarter of 2015, with eight closing totaling $21.4 million at an average price of $78.75/SF. This does not include the foreclosure sale of the 448,000 square foot Frederick Office Park that changed hands at $20,000,000 in February of 2015.

Mixed Use Commercial/Residential Real Estate

The vast majority of the 9 closed transactions in this sector for 2016 consisted of downtown properties with first floor retail and residential above. The median square footage equaled 1,777 at a price of $277,400. In the same period last year there were 10 closings of similar properties at a median price of $147,500 at 1,841 SF each. Sales price per square foot average $125 this year compared to $102/SF in 2015. The significant difference here is clearly found when drilling into the location and quality of the properties sold this year over last.

Office Product

The 9 sales in this sector included office buildings and office condominiums. The top sale took place in February of this year for a 13,305 SF condo in the Wormald office buildings at 5205 Chairmans Court in the Westview Office Park for $3,198,150 at a price of $240.37/SF. The smallest transaction was a January sale for $160,000 for a 900 square foot unit at 3 College Avenue in Frederick. All told over 53,390 SF transacted for a price of $9.9 million versus 4 closing totaling 12,970 SF for $2.4 million in 2015. Average sales price per square foot equaled $185.50 and $177.80 respectively.

This is very good news for the still well under-absorbed office market in Frederick.

Retail Real Estate

Once again this is a sector that far exceeded the first quarter of 2015. While last year showed 5 closing totaling over $6.7 million, the same period this year nearly tripled that figure with $19.3 million in sales across 8 transactions. Last year’s average per square foot figure of $286.27 was unmatched by that of $201.46 here in 2016. But that is not the whole story, as this past February sale of the new CVS store on Middletown Parkway at $5.7 million topped $427/SF.

Specialty Use Properties

There are always some very interesting transactions that fall into this sector. In the 1st three months of last year Vinobona Nursing Home in Braddock Heights was the top deal at a price of $3 million for the 25,000 square foot facility sitting on 16.9 acres. This year another and more modern nursing home sold in the same period for $17.5 million. The 69,000 SF and 196 bed Northhampton Manor Health Center is a state-of-the-art rehabilitation facility located at 200 E 16th Street in Frederick.

Two other churches sold in Frederick County in March of this year rounding out the balance of the $18 million sales in this sector. Last year the other 2 closings included a daycare center and a former building that housed the Lions Club in Yellow Springs.

Hospitality

The Sleep Inn located at 5361 Spectrum Drive just east of the Francis Scott Key Mall was the single transaction in this sector of quarter one. The 84 room hotel sold for a reasonable price of just over $37,000 per key … that’s $3.11 million in layman terms. Last year the quarterly single deal was the sale of Frederick’s infamous Travelodge at a price of $4.5 million.

Multifamily

In the first quarter of 2015 one could hear crickets chirping in the dead of winter, as not a single apartment transaction took place. This year there was a $556,000 sale at 11 E Second Street in downtown Frederick and the well-hidden 16 unit Dreamers Cove Apartments at 302 Baughmans Lane sold for $2 million. That equals a figure of $125,000 per unit – not bad.

Land Sales

Last year there were 7 land closings in Q1 of 2015 that totaled $7.1 million. These included land zoned for retail/commercial use as well as office and mixed use. This year saw only 4 transactions that totaled $1.46 million with only one exceeding an acre, and that being 1.75 acres. It was a mix of small single user industrial and commercial sites.

All in all a promising first 3 months for 2016. While seventy-one percent of the 38 closings traded hands at less than $1 million, the eleven remaining transactions above that figure totaled 84% of the $56.9 million. This closely mirrors the 81% of transactions in Q1 of 2015 that topped the one million dollar mark.

If you’d like to get more content like this delivered directly to your inbox, join our online community of MacRo Insiders today!

Rocky Mackintosh, the Founder and President of MacRo, Ltd., is a leading commercial real estate expert in the region.He has been an active member of the Frederick, Maryland community for over four decades. He has served as chairman of the board of Frederick Memorial Hospital and as a member of the Frederick County Charter Board from 2010 to 2012.