Sometimes landlords feel like they are running a concession stand at the local carnival.

They say timing is everything, but if you are a landlord, who has invested in the commercial real estate market for the long haul, you can expect to see everything the market has to offer.

timing is everything, but if you are a landlord, who has invested in the commercial real estate market for the long haul, you can expect to see everything the market has to offer.

MacRo, Ltd. is in the business of assisting property owners with making wise investment decisions, such establishing lease terms that will maximize the value of their real estate.

Very often I meet with an investor who has been managing and leasing their own property for many years. As a matter of policy, the owner has offered below market rents to fill vacant units quickly.

Since the rent rolls of properties have a significant impact on the property value, many investors often find themselves held hostage by those leases.

It is important for the owner of commercial real estate investment properties (be it a retail, office, flex space or industrial space) to practice some basic leasing strategies, when marketing vacancies.

Here is one to chew on:

Free Rent is often better than Low Rent!

At first glance, this may appear to make no sense, but all too often, I find that property owners will negotiate a low base rent with a tenant, just to get a vacant unit filled. That base rent sometimes may (or may not) have an annual rent escalation clause built into the terms of the lease. In the Frederick County commercial real estate market, the typical escalator is about three percent.

The long term impact of lower than market rent can have a negative impact on the future value of the property. Sometimes, under the right circumstances, offering as much as several months or more in free rent and using a base market rate rent can provide the tenant with the necessary incentive to lock into to a long term lease without giving away future increased cash flows.

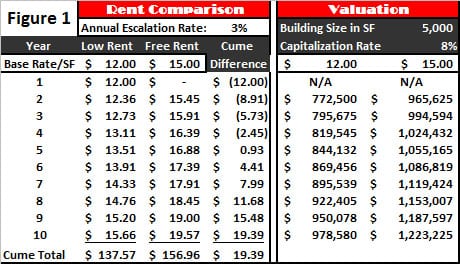

The left half of Figure 1 shows a simple example of how this logic works. Consider a situation where the market rate is $15.00 per square foot and a tenant offers $12.00 for a ten-year lease. In the long run, the landlord makes out better if the tenant will agree to sign at $15.00/SF with a concession equivalent to a one year rent abatement verses a $12.00 rate without abatements.

The left half of Figure 1 shows a simple example of how this logic works. Consider a situation where the market rate is $15.00 per square foot and a tenant offers $12.00 for a ten-year lease. In the long run, the landlord makes out better if the tenant will agree to sign at $15.00/SF with a concession equivalent to a one year rent abatement verses a $12.00 rate without abatements.

From an appraisal perspective, if one were to value such a property based upon an income approach alone (using a capitalization rate of say 8%), after the first year, the $15.00 rate shows the value of the real estate to be worth 25% more than that of the $12.00 lease rate.

The right half of Figure 1 gives an example of the value differential for a 5,000 square foot free-standing office building using the above lease terms, showing that the factor 25% carries over from lease rate to value.

Now obviously, other factors will go into a full appraisal, such as consideration of comparable sales, property condition, and replacement costs … just to name a few.

Do you have a commercial leasing question for our team at MacRo, Ltd?

We are just a phone call away.

Rocky Mackintosh, President of MacRo, Ltd., a Land and Commercial Real Estate firm based in Frederick, Maryland, has been an active member of the Frederick community for over four decades. He has served as chairman of the board of Frederick Memorial Hospital and as a member of the Frederick County Charter Board from 2010 to 2012. He currently serves as chairman of the board of Frederick Mutual Insurance Company. Established in 1843, it is one of the longest enduring businesses in Frederick County.