While the CRE sales count holds steady, the average sales price and dollar volume drop by more than 60% from same period of 2015

Surprises come in different shapes and forms every time we at MacRo, Ltd. run the quarterly CRE stats for Frederick County.

It was in the 1st quarter of 2016 that commercial real estate sales transactions offered the promise of a booming forecast for the blossoming year when the figures showed a 19% increase in the average sales price and dollar volume over the first three months of the previous year.

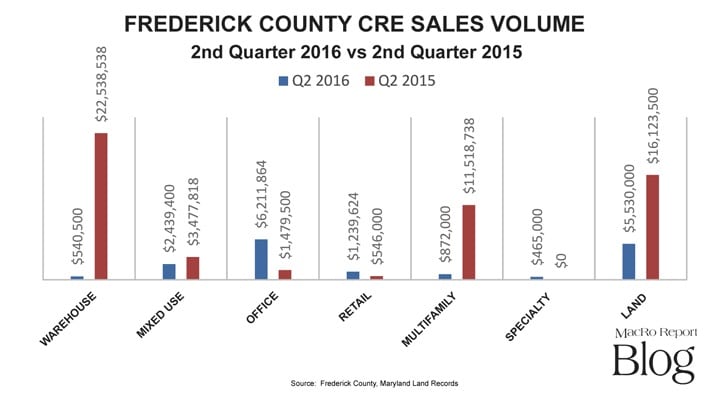

But not the second quarter, as the picture flipped the other way this time – the average per unit sales price of all recorded transactions fell by 62.7% from $1.86 million to just $665,000, and total dollar volume dropped by nearly 70%!

The sort of good news was that the number of transactions for the quarter was only off by 4 – 26 down from 30. Total sales volume for the period was a mere $17.3 million compared to Q1-15’s $55.7 million.

The significant difference skewed the charts for the year-to-date totals as well with figures thus far being only 71.8% of 2015’s YTD of $103.4 million.

Sector by sector comparisons show that there were only five transactions out of the 26 that exceeded one million dollars.

Industrial Property

There were only three sales of warehouse properties: one at $270,000 and two others around $135,000. Compare that to the 8 transactions that totaled over $22 million in Q2 of 2015, and one can see already where a significant part of the difference is. While it is a small sampling, the average price per square foot fell from $97 to $68!

Mixed Use Commercial/Residential Real Estate

Only four sales made the charts in this sector compared to 11 that time last year. All 4 were smaller downtown properties (3 in Frederick and one in Jefferson). Sales volume was off by a cool mil, but the average price square foot held steady with a slight bump to $136.

Office Product

Here’s where some positive news was made! Out of the six deals struck, two exceeded one million dollars, with one being a 12,600 SF office condo sale from Wormald to Alliance Trust at 5205 Chairman’s Court (Suite 100) in April of this year for $3.82 million. Seems that Wormald is making an effort to get out of the office building business by selling off product.

Retail Real Estate

With only three sales in this sector, it’s barely worth mentioning with an average sale of $290,000; except for the fact there were only 3 transactions that time last year that averaged $3.8 million per.

Specialty Use Properties

This is the catch-all sector that will find institutional type uses, churches and the like. One lonely deal was struck here for a parcel known as the Jefferson Patriotic Social Club (don’t you love the name?) located at 300 E 4th Street in Frederick. Zoned Institutional, the 7,300 SF building on 0.45 acres was sold for $465,000 last April!

Multifamily

This is another one of those “What a difference a year makes” sectors. Last year in the second quarter there were 3 apartment project sales, two of which (Windsor Garden at 1101 Key Parkway and Little Brook Apartments located on a street by the same name) reached a sum total of $11.3 million. The same period this year closed 4 transactions totaling $872,000 that ranged in price between $151,000 and $345,000. Two were located on Maryland Ave in Braddock Heights and the other 2 on East Patrick Street.

Land Sales

Now, we do not include farmland sales in this sector, but it does include land zoned for retail/commercial use as well as office and mixed use. Out of the five transactions that exceeded $5.5million, two were noteworthy: 3.45 acres sold in the Frederick Industrial Center on Grove Road for $2.4 million and the 48.48 heart of the Coplay Cement Company quarry just north of Buckeystown was sold to another quarry entity (5703 Urbana Pike LLC) for $1,440,000 in June.

Take-Aways

Yes, the figures may surprise many who follow the Frederick County CRE stats, but, no, the economy is not coming to a screeching halt. Across the board here at MacRo, Ltd. we have experienced strong activity in a number of sectors beyond CRE sales. Farmland sales have created a lot of volume through our office, as well as a serious spike in commercial leasing activity.

The transaction pace is only off slightly for the year with only a handful of large deals recorded. Last year we made note of a couple of significant foreclosures (or as some may like to call them “financial restructurings”) of large projects, so far this year not much has happened; so we haven’t even included them in this post.

All-in-all the forecast from this vantage point is that the economy is ever so cautiously, but steadily improving and Frederick will continue to benefit from it!

Rocky Mackintosh, the Founder and President of MacRo, Ltd., is a leading commercial real estate expert in the region. He has been an active member of the Frederick, Maryland community for over four decades. He has served as chairman of the board of Frederick Memorial Hospital and as a member of the Frederick County Charter Board from 2010 to 2012.