CRE Sales top the $300,000,000 mark with sales in the Industrial Sector consuming 32%, but a foreclosed business park can’t be ignored.

With all the 2015 figures now in the record books for transfers of Commercial Real Estate in Frederick County, Maryland, some very interesting statistics were revealed.

Reaching New Heights

Overall transferred volume increased by a solid 15% from a 2014 figure of $257,964,124 to $300,840,856, and $26 million above the mark reached in 2013. The number of transactions in the local market fell by 4 transfers from the previous year figure of 147. The total square feet of improved commercial properties sold last year was 11% greater, which reached a mark of 2.37 million.

This $300 million high water mark for CRE transfers in Frederick County happens to be 150% of the $200 million reached in 2012. Generally, this would be considered all good news, but as typically happens in any calendar year of transactions, there were a few forced sales. In this past year two foreclosures totaled 8% of the dollar volume. And 21% of the square footage that moved contributed to pushing the numbers to new heights.

Slicing and Dicing the Numbers

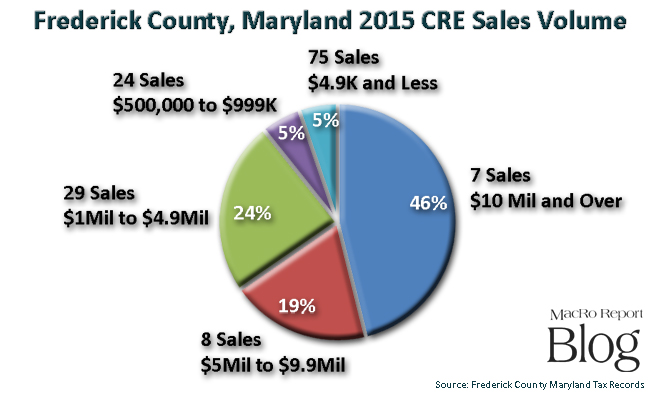

Dollar volume by price points show how only seven transactions consumed a whopping 46% of property sold at $10 million and greater, but a breakdown of each sector reveals a lot as well.

Mixed Use Commercial

The largest number of transfers in 2015 took place in the Mixed Use property type. Properties that included different uses or are zoned for such things as retail, office, residential. Forty-three of the 143 became the bread and butter for the vast majority of the commercial sales brokerage community. The total of $9.3 million averaged a unit size of 2,200 square feet at $218,000 per sale.

Industrial – Flex and Warehouse

While mixed use controlled 30% of the transactions, the sales of industrial properties, which includes warehouses, flex industrial and office space, garnered 32% of that $300 million in volume. The $20 million foreclosure sale of the 448,000 square foot Frederick Corporate Park Office Park Complex in February of last year was only one of the 26 transactions that took place. Extracting this transfer from the pool, left an average sale of $1.88 million per deal at around a healthy $102 per square foot factor.

Office

Just under 167,000 square feet of all kinds of office product sold in 21 transactions averaged $208 per square foot. This represented 7% of all square footage sold and 12% of the dollar volume in 2015.

Retail

This sector closely followed that of the office market with 20 transactions totaling nearly $38 million in sales volume with an average sales price of $1.9 million for a building (or unit, if a condo) of about 10,000 square feet per transaction.

Developable Land

There were 14 vacant land transactions that the Frederick County transfer records showed as developable property for commercial, industrial, office or mixed use. Total sales volume came in third among the commercial sectors with $45 million. Three of these transactions included and land condo transaction for the Cross Stone Commons CVS in Middletown, the sale of part of the Renn farm to Matan near the airport, and a $7.99 million transfer at Jefferson Tech Park. Leaving those transactions out of the mix, the sales prices per acre ranged from a low of $1,500 to $750,000.

Multifamily

With over $60 million of volume in this sector, the eleven transactions may have one thinking that there were a lot of $5 million sales last year. But looking under the hood a little closer reveals that the largest single sale took place in Frederick’s multifamily market. The Retreat at Market Square Apartments sold for $44.75 million, which gobbled up 75% of that dollar volume. The remaining ten transfers averaged just shy of $1.6 million each.

Special Purpose and Hospitality

Lumping these two sectors together for this blog post seemed appropriate, because between the two of them they yielded seven sales and one foreclosure. All told the $17 million in dollar volume only made up about 5% all CRE transferred in 2015. It was the owners of the beleaguered Travelodge at 20 Monocacy Boulevard who saw the infamous motel forcibly change hands at $4,500,000 in March of last year.

All in All – a Good Year for CRE

While 2015 surely didn’t provide the prices and units sold that the commercial brokerage community, their investors and developers experienced a decade ago, it was a fine year for Frederick County Commercial Real Estate, which hopefully has laid a foundation for an even better 2016.

In a future post, I’ll dig deeper into the most interesting of last year’s sales.

Stay tuned!