It’s almost impossible to write a blog article right now that doesn’t concern COVID-19 in some way, shape, or form.

The novel coronavirus has affected everyone’s life, and it is the primary thought in most people’s minds. The terrible toll the virus has taken on the health and safety of humankind is frightening, and the actions taken to contain the virus have thrown our economy into a parallel crisis.

coronavirus has affected everyone’s life, and it is the primary thought in most people’s minds. The terrible toll the virus has taken on the health and safety of humankind is frightening, and the actions taken to contain the virus have thrown our economy into a parallel crisis.

The effect on real estate markets has been sudden, substantial, dramatic, and possibly unprecedented. In late February, the US economy was performing at an historically high level, and real estate markets were buzzing along quite well. In March, the threat from COVID-19 on the US economy became manifest: mandatory shutdowns, stay at home orders, and social distancing were implemented. By April, large portions of the economy were at a standstill, unemployment had skyrocketed and fears of supply chain failures became real. The change in the economic environment from February through May has been stunning.

Consequently, some real estate sectors – notably the retail, travel, and entertainment sectors – have been hammered. Other sectors – including the warehouse and industrial sectors – have not suffered nearly as much. Commercial real estate sales and leases take many months to come to fruition, so even the initial impacts from the pandemic on commercial markets will only be discovered over a fairly long period of time.

In contrast, the residential sales market has a much shorter gestation period, the data is abundant and is available with little lag. This article focuses on the short-term response of the residential sales market to the pandemic.

How has the residential market in Frederick County behaved over the past few months (just prior to and during the pandemic)? The answer is “surprisingly well”, at least so far. When reviewing the data below, keep in mind that while real estate was classified as an essential industry in Maryland, many aspects of the industry changed significantly making the entire sales process more difficult: open houses are verboten, most sellers and agents have placed restrictions on showings, the pool of buyers has shrunk, due to lost/reduced income, and lenders and settlement companies have changed their operating procedures to comply with social distancing.

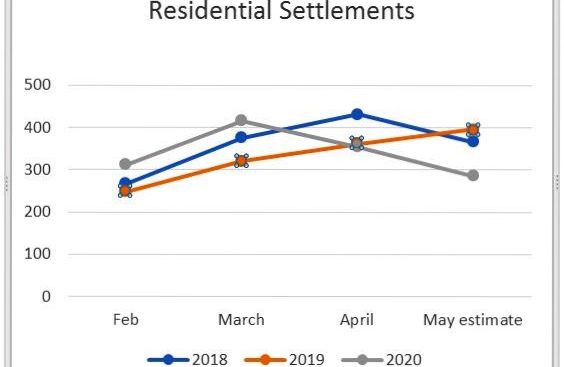

Provided herein is a graph comparing the number of settlements, which have occurred during each month of the relevant period over the past three years:

Provided herein is a graph comparing the number of settlements, which have occurred during each month of the relevant period over the past three years:

As might be expected, the trend during the pandemic has been downward, as settlements have dropped each month from March through May. When compared with the prior two years, the trend over the same months has generally been up. However, while the current downward trend is worrisome, it is alleviated by the fact that contract executions seem to be rebounding as shown on the graph below.

In 2018 and 2019, there was a consistent trend upwards from February through April as the “spring market” kicked in. In the current year, the trend was down, as the market adjusted to life during a pandemic. Surprisingly to me, the downward trend was not more pronounced. The number of contracts executed in April 2020 was 16% lower than the same period in 2019, but the projection for May 2020 is slightly above 2019’s figure and represents growth of 36% over the April 2020 figure.

In 2018 and 2019, there was a consistent trend upwards from February through April as the “spring market” kicked in. In the current year, the trend was down, as the market adjusted to life during a pandemic. Surprisingly to me, the downward trend was not more pronounced. The number of contracts executed in April 2020 was 16% lower than the same period in 2019, but the projection for May 2020 is slightly above 2019’s figure and represents growth of 36% over the April 2020 figure.

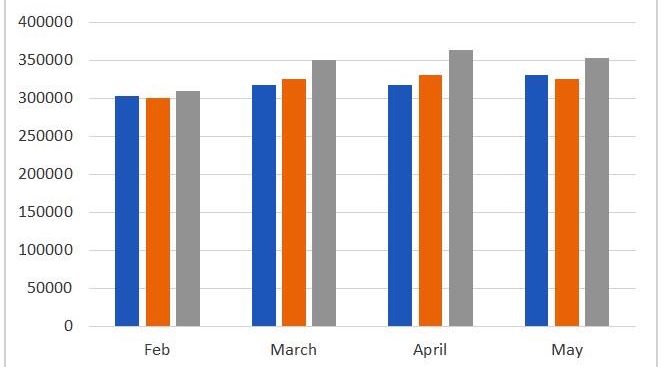

How have prices been affected? The graph below shows the median sales price of all residential sales, during the relevant periods.

This graph indicates that the market is healthy and growing. While the median price for May 2020 was slightly below that for the prior month, it was 8.6% above the May 2019 figure. Also, note that for each given month, the median price has trended upwards over the three-year period.

graph indicates that the market is healthy and growing. While the median price for May 2020 was slightly below that for the prior month, it was 8.6% above the May 2019 figure. Also, note that for each given month, the median price has trended upwards over the three-year period.

Overall, the data suggests that the residential market in Frederick County has been resilient to the scourge of COVID-19, at least in the short run. Only time will tell how the pandemic itself and the market’s reaction to the pandemic play out.

All of us at MacRo, Ltd. wish you and yours good health and prosperity into the future. Rocky, Ashleigh, and I are available and ready to assist you in your real estate endeavors – please do not hesitate to contact us.

Thanks Dave for your informative blog. Highly relevant right now. Be interesting to see same numbers for the next two quarters.

Stay well and be safe.

Craig