Why would any landlord take an average annual rent loss to fill a 60,000 SF space?

If there is one segment of the commercial real estate market in Frederick, Maryland that is still licking its wounds from the great recession of 2009, it is office leasing.

If there is one segment of the commercial real estate market in Frederick, Maryland that is still licking its wounds from the great recession of 2009, it is office leasing.

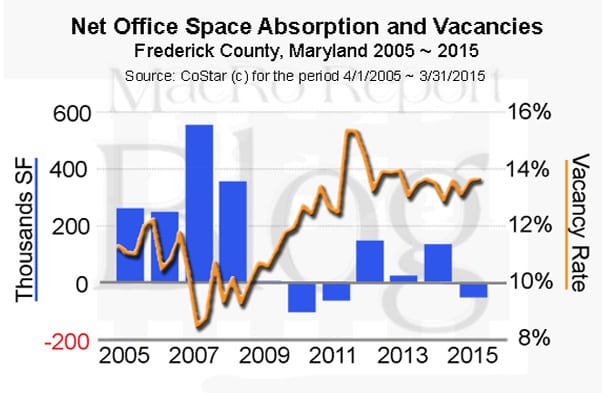

With very little new office space construction taking place in during that period, the nearly 8.5 million square feet within nearly 645 Class A, B & C buildings throughout Frederick has suffered through most of the negative phases of the business cycle: contraction, closure and exodus to greener out-of-county opportunities.

Of recent note has the been the official notice that the Bechtel Corporation has begun its move to Northern Virginia, by vacating the first 125,000 of the 450,000 square feet it has occupied for years at 5295 Westview Drive just south of the City of Frederick.

Presently CoStar, the world’s leading commercial real estate data base, shows about 1,440,000 square feet of available space in the county, which is a rate of 16.6%. This is 3% higher than the Vacancy Rate, as the Availability Rate not only includes empty space, but also currently occupied space that is scheduled to be vacant by the end of the current quarter.

While the 5 year average amount of leased space comes to 318,000 square feet, after all those recessionary negatives are factored in to the equation, the net annual absorption for the same period has averaged 19,673 square feet or not quite 1.5% per year of the average annual amount of vacant square feet. To put it another way, over the last 5 years, for every 106 square feet leased, there’s another 100 square that becomes vacant.

So since 2009 the Frederick County commercial office market has barely broken even with new leases written versus existing tenants exiting their space.

Digging deeper into a building by building look, it is clear that the competition has been fierce among landlords.

These property owners seek full service lease rates that hover around $21.00 per square foot, which include building operating expenses (such items as maintenance, utilities, real estate taxes, insurance and management) typically range between $8.00 and $10.00 per square foot. That stated, the net effect of competition to fill buildings can often drive these figures so low that many find it hard to believe that “such a deal” was actually inked.

Take for example the case of Maritz Holdings, Inc. (aka Experient) which occupied for many years almost 75% of 83,000 square feet at 1888 North Market Street. The Galaxy Building, as it is referred to, was built in the 1980’s in a Class C location surrounded by limited industrial storage lots and other mixed uses. Martiz chose to throw its Fortune 100 Company weight around and went shopping for a location and property of higher status … not to mention a better lease deal.

In late 2012 after a very thorough search, it settled on making a new home at 5202 Presidents Court in the Westview Office Park. At the time this 233,000 square foot building was less than 15% occupied.

The company reached agreement at rate of $17.50 per square foot for a full service lease for 61,662 square feet (as reported to CoStar). However, within the terms of the lease the landlord provided the tenant with $50.50 per square foot of interior tenant improvements.

From the landlord’s perspective, it provided Maritz with over $3,000,000 in concessions. The net result of which will yield an average Effective Rental Rate of $9.63 per square foot per for the full service lease over the 7 year term.

CoStar also noted that the operating expenses paid by the landlord are estimated to average $9.76 per square foot per annum. The true net effect of this lease from the data provided states that the landlord will yield from Maritz a net negative average annual amount of $0.13 per square foot over the life of the lease.

Put another way: The tenant is being paid by the landlord about $8,000 per year to cover 25% of the building’s operating expenses.

The question then becomes: Why would a property owner enter into such a lease?

Simply put, if the data provided to CoStar is correct, it is likely that that landlord considered the Fortune 100 Company an anchor tenant which it could be used to attract other (better) paying tenants to the building.

This can be substantiated by the fact the since the June 2013 occupancy of the building by Maritz, an additional 62,000 square feet has been occupied with new leases or renewals.

It is likely that landlords of other large blocks of vacant office space (like the Galaxy building – now over 75% empty) will also have to make aggressive plays to fill the floors that have been gathering dust for months and years. That stated, while this may seem a gloomy forecast, it is clear that over the first three months of this year activity has picked up considerably and deals are getting inked; so as the competition among Frederick landlords remains fierce, the trend appears to be positive.

Want to read more about what the MacRo Team thinks of the office market for Frederick real estate? Click here!

The author: Rocky Mackintosh, President, MacRo, Ltd., a Land and Commercial Real Estate firm based in Frederick, Maryland. He has been an active member of the Frederick, Maryland community for over four decades. He has served as chairman of the board of Frederick Memorial Hospital, as a member of the Frederick County Charter Board from 2010 to 2012, and currently serves as Co-Chairman of the Economic Development Advisory Council to the Mayor of the City of Frederick … to name a few.